Printable Stock Chart Patterns - In other words, they can help you identify potential turning points in the market, and allow you to time your trades more accurately. 🖼 printable picture below (right click > save image as…) in finance, technical analysis is an analysis methodology for forecasting the direction of prices through the study of. Web reversal patterns bullish triple bottom triple top cup & handle inverted cup & handle ascending triangle descending triangle bullish symmetrical triangle bearish symmetrical triangle. Web here is a chart of common bullish, bearish, and reversal trading patterns that play out in markets. Web on a very basic level, stock chart patterns are a way of viewing a series of price actions that occur during a stock trading period. What are stock chart patterns; It helps to print it out and tape it to your monitor or put in your notebook. Breakout patterns can occur when a stock has been trading in a range. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period. Web in this post, we will explore what chart patterns are and how you can incorporate them into your own trading.

Printable Stock Chart Patterns Customize and Print

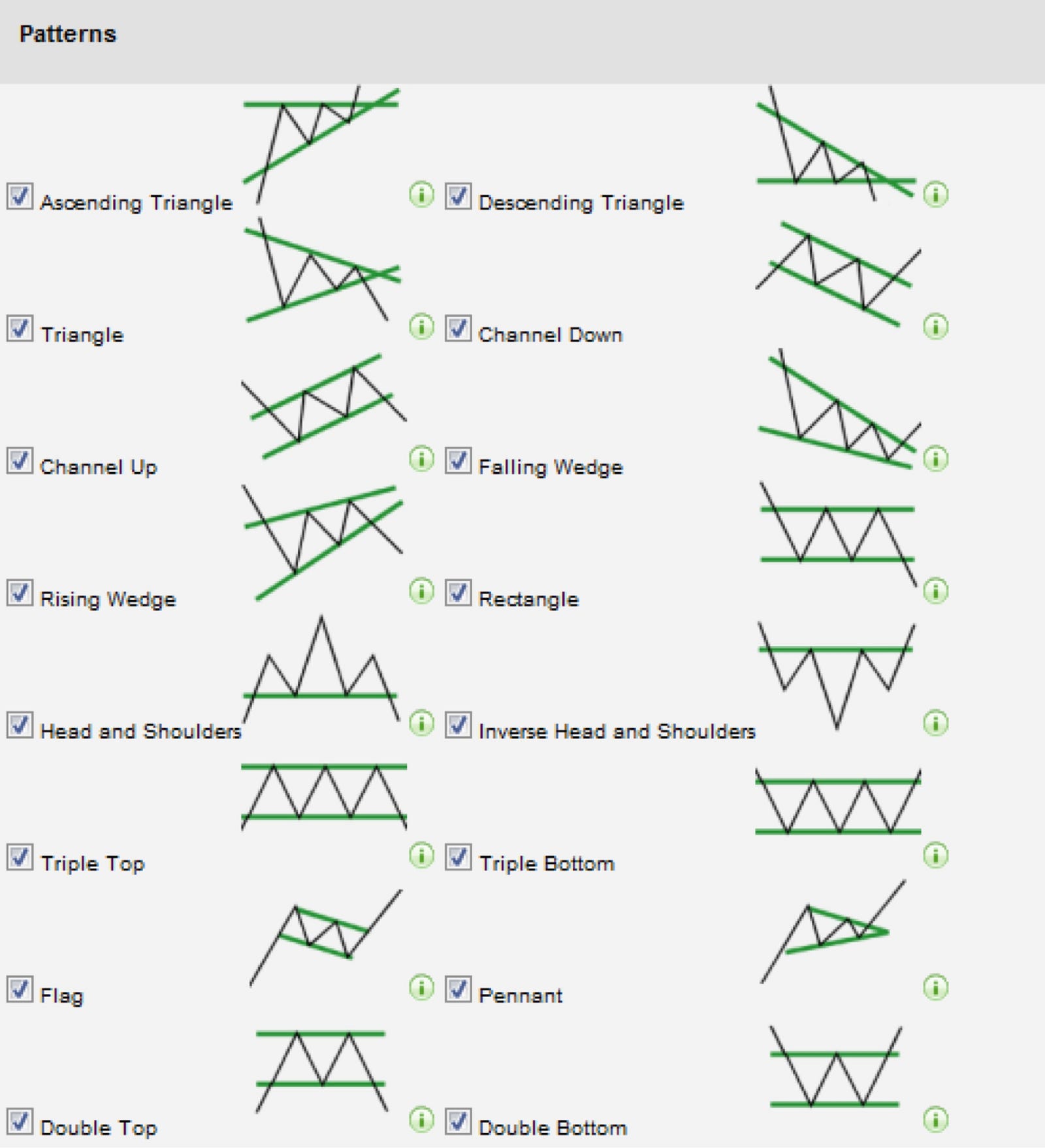

Web discover the top 23 stock chart patterns favored by technical analysts for over 100 years. Whether you are an experienced trader or new to the world of trading, understanding and utilizing chart patterns can greatly improve your trading outcomes. The top of the range is resistance, and the bottom is support. Breakout patterns can occur when a stock has.

Printable Stock Chart Patterns

The great thing about chart patterns is that they tend to repeat themselves over and over again. Web there are three key chart patterns used by technical analysis experts. Web by hugh kimura traders that use technical analysis often use chart patterns to identify potentially profitable trading opportunities. Web how to read stock charts and trading patterns. Breakout, continuation, and.

Printable Chart Patterns Printable World Holiday

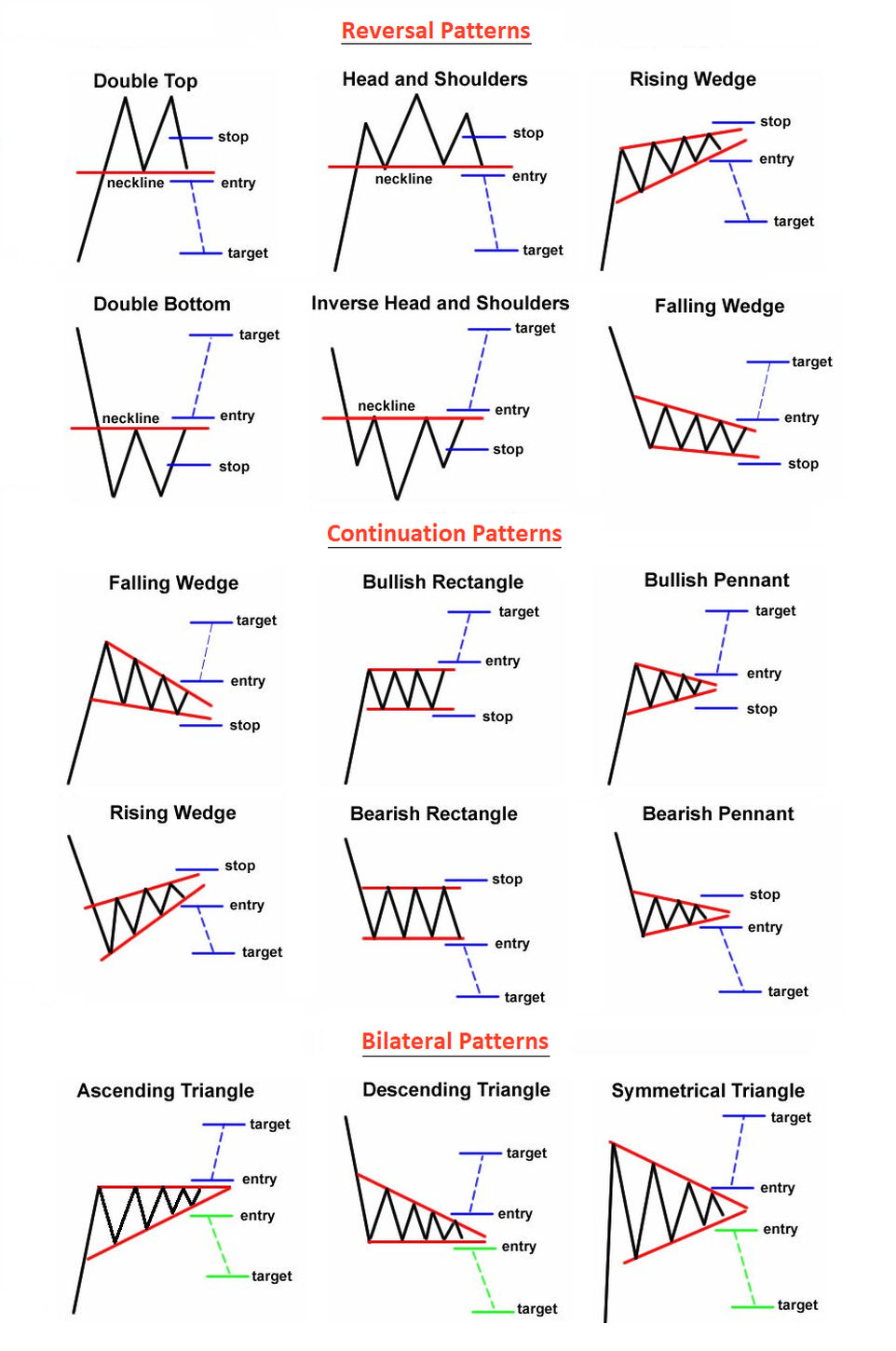

The most popular stock chart patterns are the channels, rectangles, cup with handle, head and shoulders, rounded tops and bottoms, and many more. Reversal patterns double top reversal double bottom reversal head and shoulders top head and shoulders bottom falling wedge rising wedge rounding bottom triple top reversal triple bottom reversal bump and run reversal continuation patterns Web how to.

Chart Patterns Cheat Sheet PDF PDF Marché boursier, Graphique

Technical analysts and chartists seek to identify patterns. Chart patterns cheat sheet created date: Breakout patterns can occur when a stock has been trading in a range. Managing risk with technical analysis manage your trading risk with a range of confirmation methods. The trend line break is their signal.

Harmonic Patterns Related Keywords Amp Amp Suggestions forextrading

Web chart patterns definition chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading ). Web hey here is technical patterns cheat sheet for traders. The most popular stock chart patterns are the channels, rectangles, cup with handle, head and shoulders, rounded tops and bottoms,.

Tweets with replies by beanfxtrader (beanfxtrader) Twitter Stock

Web here is a chart of common bullish, bearish, and reversal trading patterns that play out in markets. Breakout, continuation, and reversal charts fall into one of three pattern types — breakout, reversal, and continuation. Chart patterns cheat sheet created date: Major price advances occur after a stock breaks out from a strong, recognizable chart pattern. Breakout patterns can occur.

Chart Patterns B.P. Rising B.P. RISING

It helps to print it out and tape it to your monitor or put in your notebook. These are traditional chart patterns, harmonic patterns and candlestick patterns (which can only be identified on candlestick charts). Technical analysts and chartists seek to identify patterns. Of course a trader must manage a trade taken with one of these breakouts using the right.

📈📉 Ultimate Chart Pattern Cheat Sheet! Reversal Double top Tripple top

Managing risk with technical analysis manage your trading risk with a range of confirmation methods. 🖼 printable picture below (right click > save image as…) in finance, technical analysis is an analysis methodology for forecasting the direction of prices through the study of. Whether you are an experienced trader or new to the world of trading, understanding and utilizing chart.

Chart Patterns All Things Stocks Medium

Our guide includes detailed explanations and visual examples to help you understand each pattern. Web how to read stock charts and trading patterns. Web an inverted cup and handle pattern is a bearish continuation chart pattern that appears on a stock chart, typically during a downtrend. Web the three types of chart patterns: Web reversal patterns bullish triple bottom triple.

Printable Stock Chart Patterns Customize and Print

Primary use of chart patterns; Web first few topics carry basic knowledge regarding charts. See our list of essential trading patterns to. A chart pattern, also known as a base or consolidation area, is an area of price correction and consolidation after an earlier price advance. How do you know when a stock has stopped going up?

This section will outline the most common stock chart patterns and their key features. Breakout, continuation, and reversal charts fall into one of three pattern types — breakout, reversal, and continuation. These are traditional chart patterns, harmonic patterns and candlestick patterns (which can only be identified on candlestick charts). This cheat sheet will help you remember the common chart patterns that traders use. Web an inverted cup and handle pattern is a bearish continuation chart pattern that appears on a stock chart, typically during a downtrend. Get your chart patterns pdf below. Major price advances occur after a stock breaks out from a strong, recognizable chart pattern. Web first few topics carry basic knowledge regarding charts. The trend line break is their signal. Web what are chart patterns and how can you spot them? About our coauthor charles d. Traders who use technical analysis study chart patterns to analyze stocks or indexes price action in accordance with the shape chart creates. Managing risk with technical analysis manage your trading risk with a range of confirmation methods. Web identifying chart patterns with technical analysis use charts and learn chart patterns through specific examples of important patterns in bar and candlestick charts. Our guide includes detailed explanations and visual examples to help you understand each pattern. How do you know when a stock has stopped going up? Web by hugh kimura traders that use technical analysis often use chart patterns to identify potentially profitable trading opportunities. Web there are three key chart patterns used by technical analysis experts. By understanding the trends, a trader can confirm an accurate. There is no magic in a chart pattern they just show you what happened in the past and what has a higher probability of happening in the future.

These Are Traditional Chart Patterns, Harmonic Patterns And Candlestick Patterns (Which Can Only Be Identified On Candlestick Charts).

🖼 printable picture below (right click > save image as…) in finance, technical analysis is an analysis methodology for forecasting the direction of prices through the study of. A chart pattern, also known as a base or consolidation area, is an area of price correction and consolidation after an earlier price advance. Web identifying chart patterns with technical analysis use charts and learn chart patterns through specific examples of important patterns in bar and candlestick charts. How do you know when a stock has stopped going up?

Web By Hugh Kimura Traders That Use Technical Analysis Often Use Chart Patterns To Identify Potentially Profitable Trading Opportunities.

What are stock chart patterns; Web in this post, we will explore what chart patterns are and how you can incorporate them into your own trading. Major price advances occur after a stock breaks out from a strong, recognizable chart pattern. Web chart patterns definition chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading ).

Web A Pattern Is Identified By A Line Connecting Common Price Points, Such As Closing Prices Or Highs Or Lows, During A Specific Period.

Web discover the top 23 stock chart patterns favored by technical analysts for over 100 years. Primary use of chart patterns; Reversal patterns double top reversal double bottom reversal head and shoulders top head and shoulders bottom falling wedge rising wedge rounding bottom triple top reversal triple bottom reversal bump and run reversal continuation patterns The top of the range is resistance, and the bottom is support.

See Our List Of Essential Trading Patterns To.

Then you will find explanations for 24 important stock chart patterns. Web how to read stock charts and trading patterns. Web the three types of chart patterns: Web reversal patterns bullish triple bottom triple top cup & handle inverted cup & handle ascending triangle descending triangle bullish symmetrical triangle bearish symmetrical triangle.