Nc D-400V Printable Form - To designate your overpayment to the fund, enter the amount of your designation on page 2, line 31. Sales and use electronic data interchange (edi) step by step instructions for. Web we would like to show you a description here but the site won’t allow us. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web use the create form button located below to generate the printable form. This payment application should be used only for the payment of tax owed on an amended north carolina individual income tax return for tax year 2008 to current tax year. Web follow the simple instructions below: Nowadays, most americans prefer to do their own income taxes and, in addition, to fill in papers in electronic format. For more information about the north carolina income tax, see the north carolina.

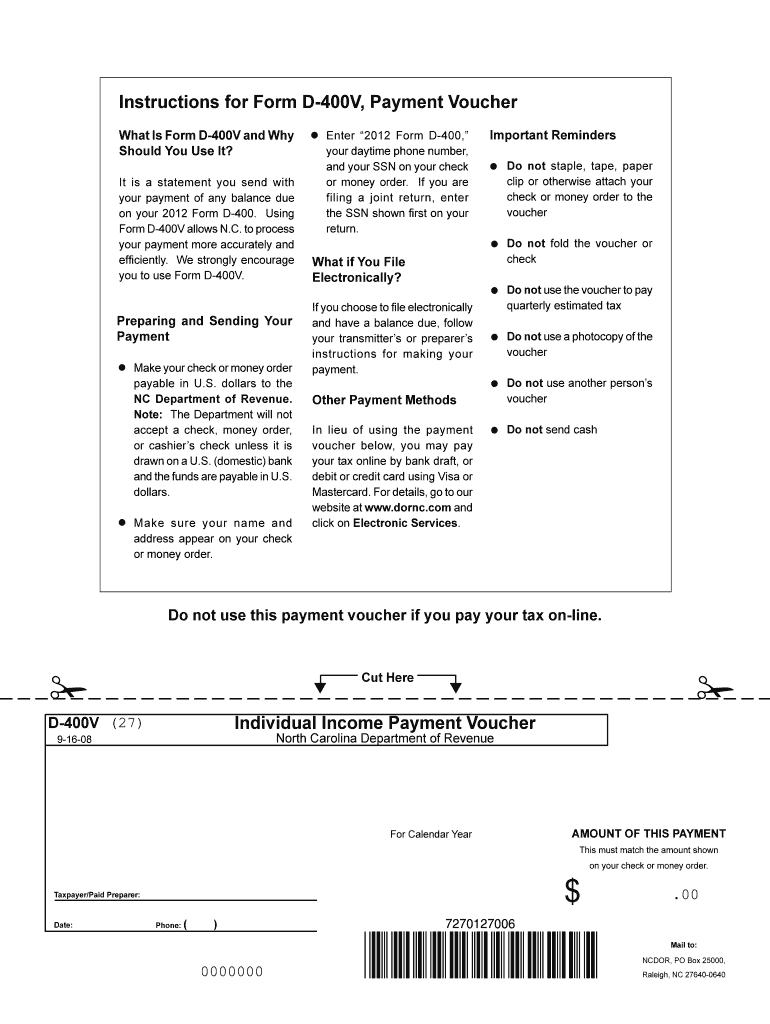

NC DoR D400V 20082022 Fill out Tax Template Online US Legal Forms

Web we would like to show you a description here but the site won’t allow us. This payment application should be used only for the payment of tax owed on an amended north carolina individual income tax return for tax year 2008 to current tax year. Web follow the simple instructions below: For more information about the north carolina income.

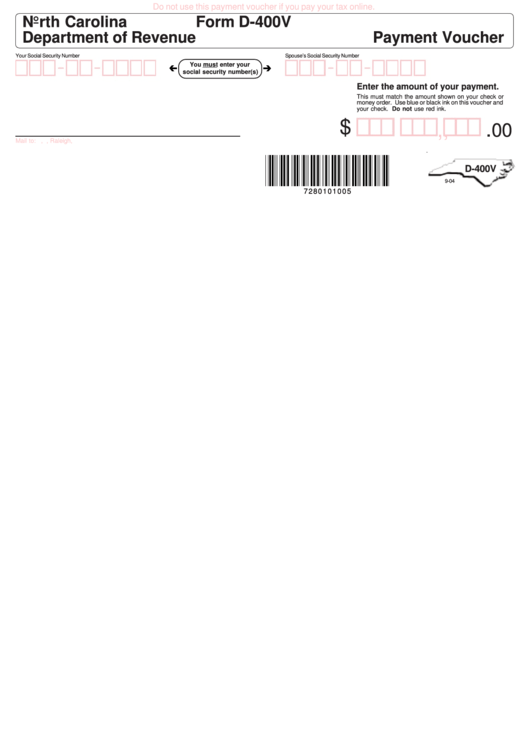

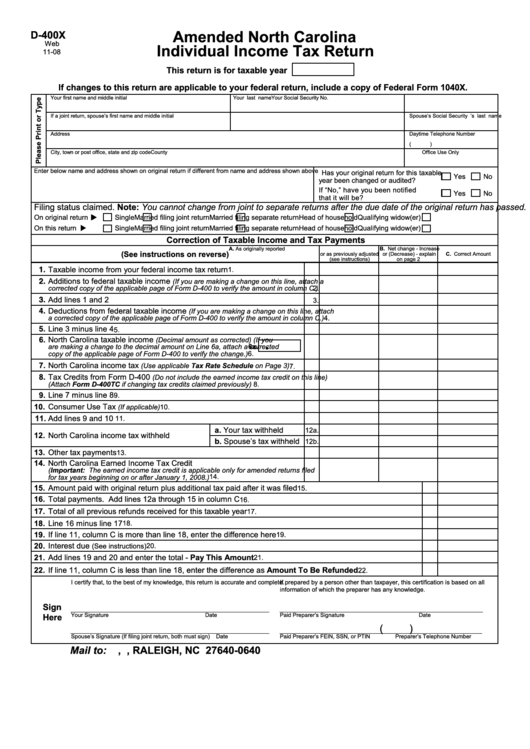

Form D400v Payment Voucher North Carolina Department Of Revenue

To designate your overpayment to the fund, enter the amount of your designation on page 2, line 31. This payment application should be used only for the payment of tax owed on an amended north carolina individual income tax return for tax year 2008 to current tax year. For more information about the north carolina income tax, see the north.

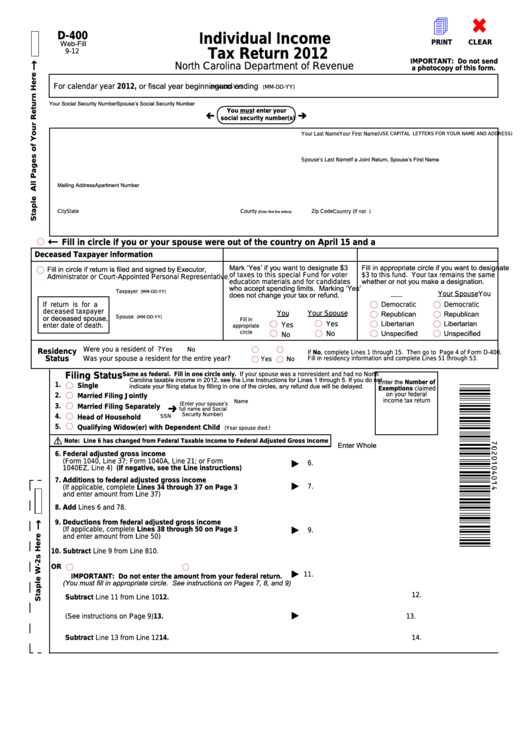

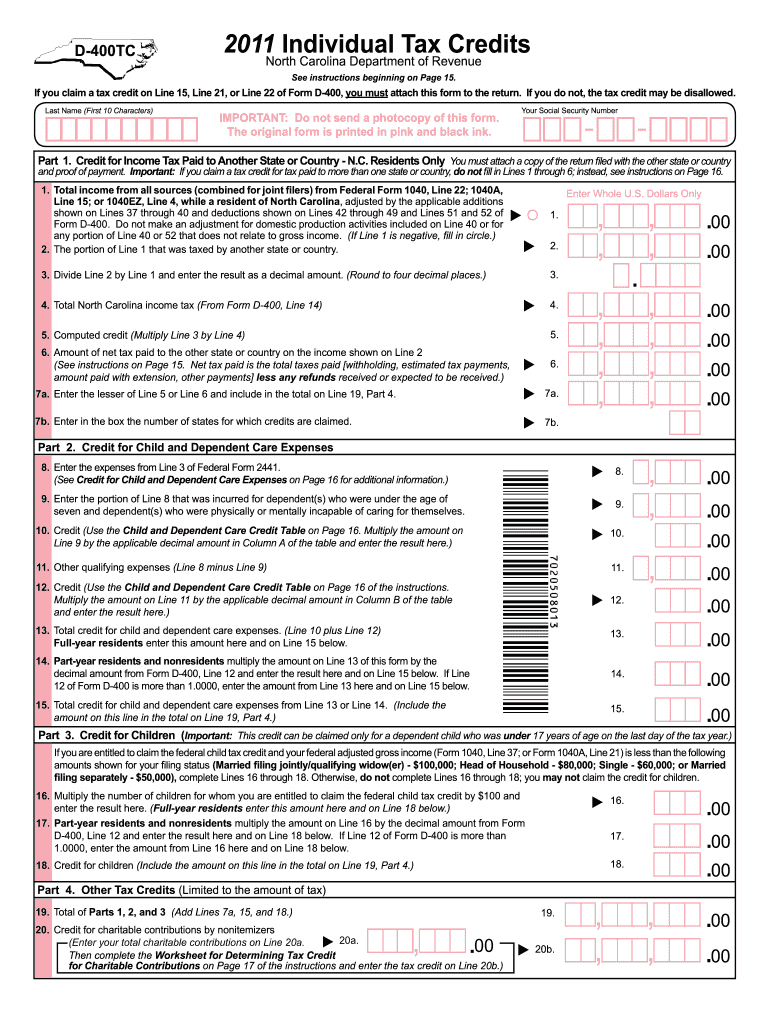

Fillable Form D400 Individual Tax Return 2012 printable pdf

Web we would like to show you a description here but the site won’t allow us. This form is for income earned in tax year 2022, with tax returns due in april 2023. To designate your overpayment to the fund, enter the amount of your designation on page 2, line 31. This payment application should be used only for the.

2014 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

Sales and use electronic data interchange (edi) step by step instructions for. Web follow the simple instructions below: For more information about the north carolina income tax, see the north carolina. This payment application should be used only for the payment of tax owed on an amended north carolina individual income tax return for tax year 2008 to current tax.

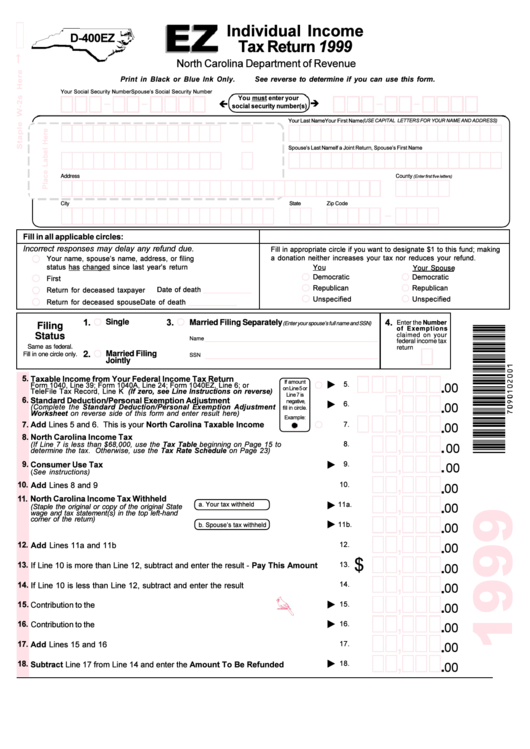

Form D400ez 1999 Individual Tax Return printable pdf download

Web we would like to show you a description here but the site won’t allow us. Sales and use electronic data interchange (edi) step by step instructions for. To designate your overpayment to the fund, enter the amount of your designation on page 2, line 31. This payment application should be used only for the payment of tax owed on.

Nc d400 instructions 2016

Nowadays, most americans prefer to do their own income taxes and, in addition, to fill in papers in electronic format. Web we would like to show you a description here but the site won’t allow us. This payment application should be used only for the payment of tax owed on an amended north carolina individual income tax return for tax.

Ncd400 Instructions Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we would like to show you a description here but the site won’t allow us. To designate your overpayment to the fund, enter the amount of your designation on page 2, line 31. Nowadays, most americans prefer to do their own income.

Top 9 Nc Form D400 Templates free to download in PDF format

Web use the create form button located below to generate the printable form. To designate your overpayment to the fund, enter the amount of your designation on page 2, line 31. Sales and use electronic data interchange (edi) step by step instructions for. This form is for income earned in tax year 2022, with tax returns due in april 2023..

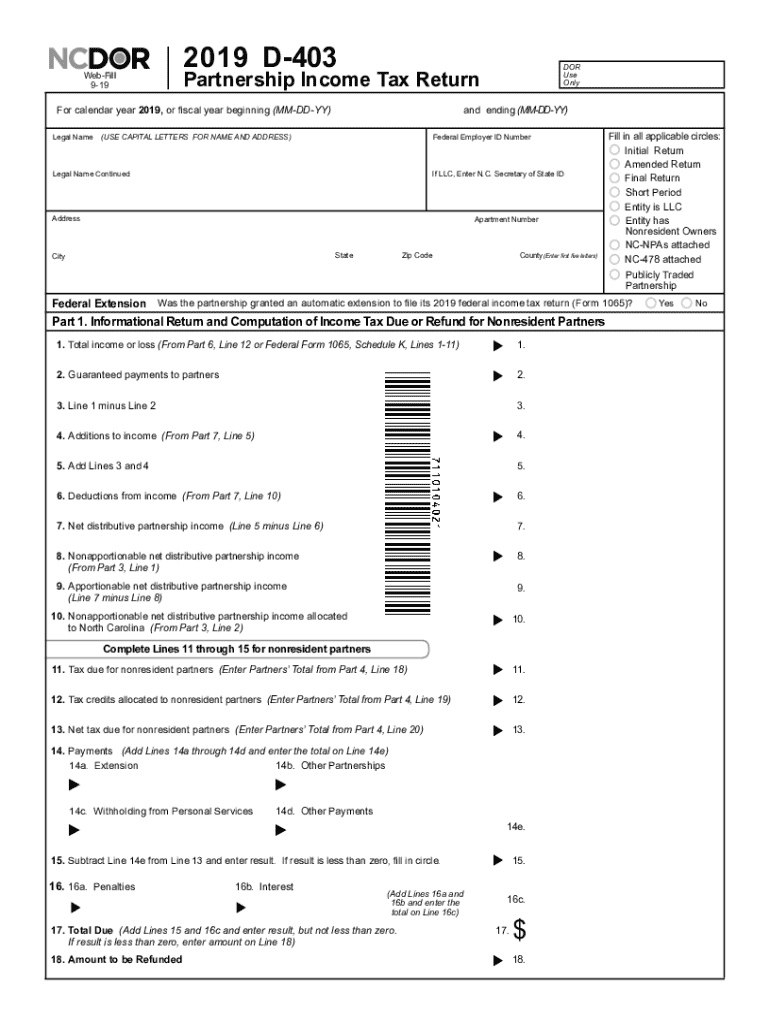

Nc K 1 Instructions Fill Out and Sign Printable PDF Template signNow

Sales and use electronic data interchange (edi) step by step instructions for. Web we would like to show you a description here but the site won’t allow us. This payment application should be used only for the payment of tax owed on an amended north carolina individual income tax return for tax year 2008 to current tax year. To designate.

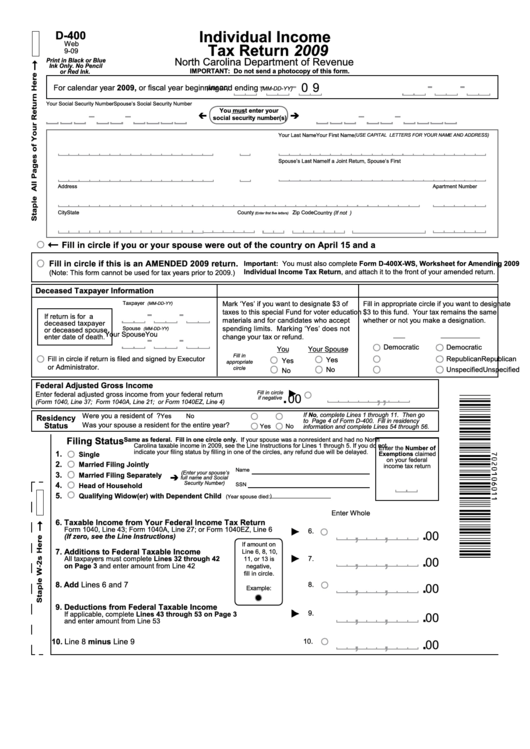

Form D400 Individual Tax Return 2009 printable pdf download

Sales and use electronic data interchange (edi) step by step instructions for. Web we would like to show you a description here but the site won’t allow us. For more information about the north carolina income tax, see the north carolina. Web use the create form button located below to generate the printable form. This payment application should be used.

For more information about the north carolina income tax, see the north carolina. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web use the create form button located below to generate the printable form. Web follow the simple instructions below: Sales and use electronic data interchange (edi) step by step instructions for. This payment application should be used only for the payment of tax owed on an amended north carolina individual income tax return for tax year 2008 to current tax year. Web we would like to show you a description here but the site won’t allow us. To designate your overpayment to the fund, enter the amount of your designation on page 2, line 31. Nowadays, most americans prefer to do their own income taxes and, in addition, to fill in papers in electronic format.

Web We Would Like To Show You A Description Here But The Site Won’t Allow Us.

Web follow the simple instructions below: Web use the create form button located below to generate the printable form. For more information about the north carolina income tax, see the north carolina. Nowadays, most americans prefer to do their own income taxes and, in addition, to fill in papers in electronic format.

To Designate Your Overpayment To The Fund, Enter The Amount Of Your Designation On Page 2, Line 31.

This form is for income earned in tax year 2022, with tax returns due in april 2023. This payment application should be used only for the payment of tax owed on an amended north carolina individual income tax return for tax year 2008 to current tax year. Sales and use electronic data interchange (edi) step by step instructions for.