Irs Form 8857 Printable - See where to file in the instructions. How do i fill out irs form 8857? Internal revenue service (99) important things you should know • do not file this form with your tax return. Web employer's quarterly federal tax return. Related tax forms what do you think? Web 8857 request for innocent spouse relief form (rev. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. Innocent spouse relief separation of liability relief equitable relief when should i file irs form 8857? • while your request is being considered, the irs generally cannot collect any tax from you for the year(s) you request relief. Web what is irs form 8857?

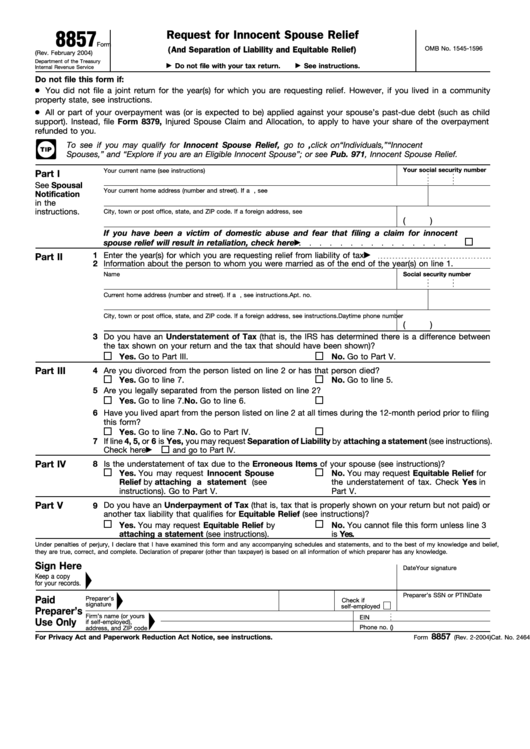

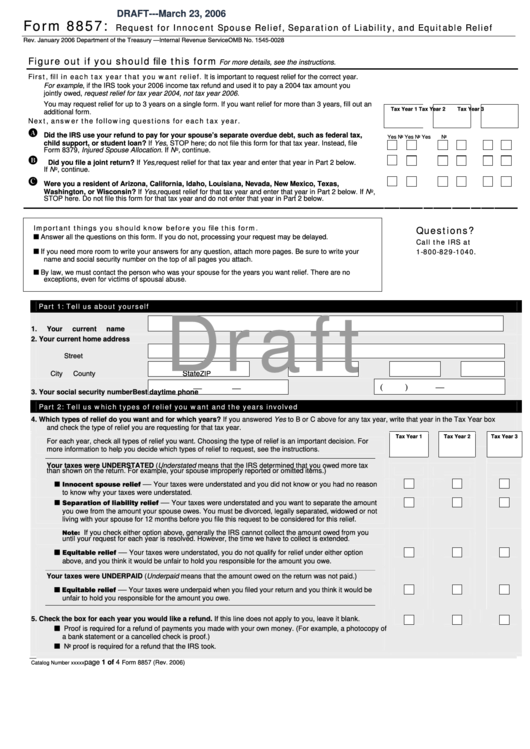

Fillable Form 8857 (Rev. February 2004) Request For Innocent Spouse

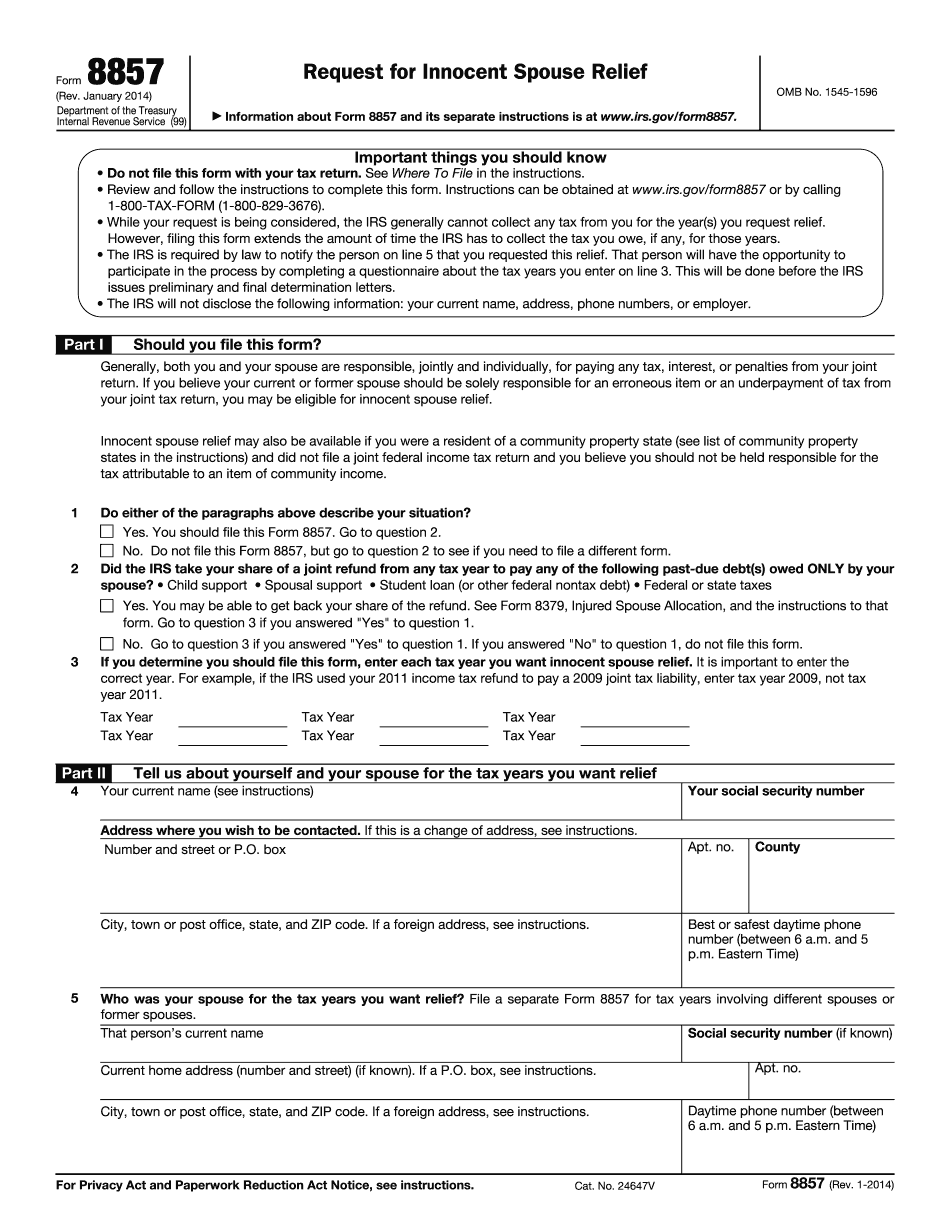

Web what is irs form 8857? Video walkthrough frequently asked questions where can i find irs form 8857? Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. Innocent spouse relief separation of liability relief equitable relief when should i file.

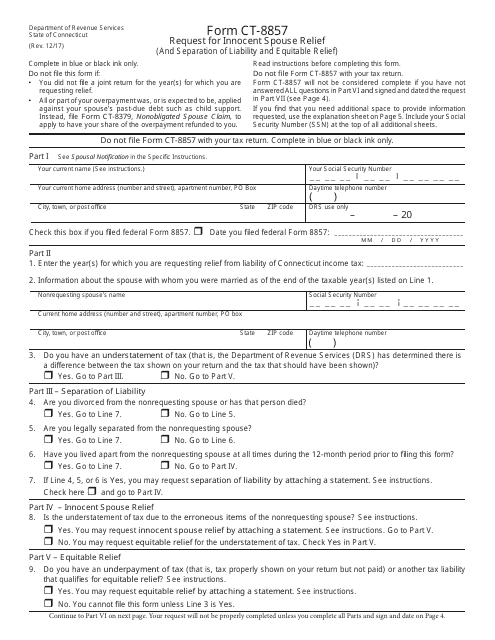

Form CT8857 Download Printable PDF or Fill Online Request for Innocent

Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web what is irs form 8857? Related tax forms what do you think? June 2021).

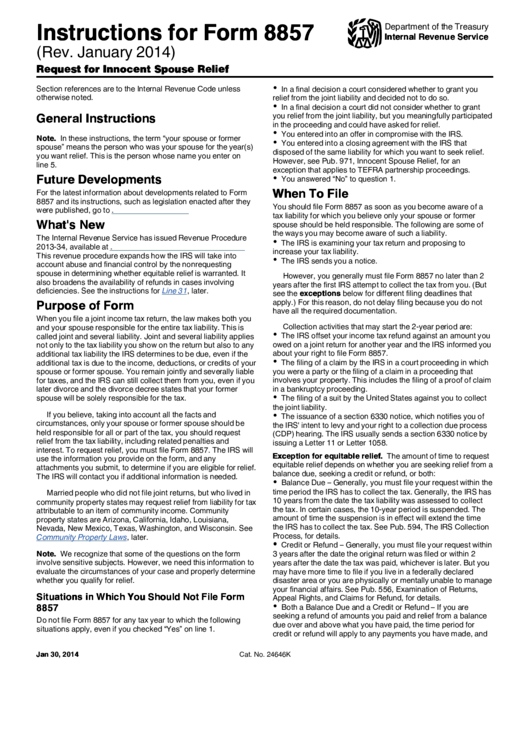

Instructions For Form 8857 (Rev. 2014) printable pdf download

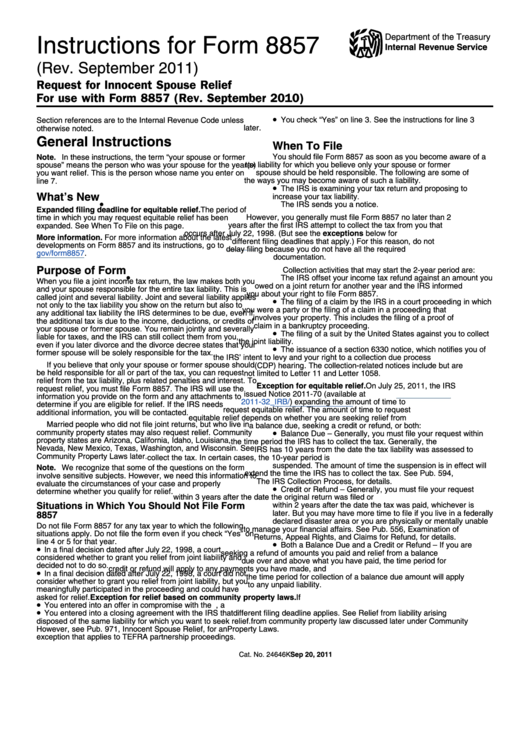

• review and follow the instructions to complete this form. Web 8857 request for innocent spouse relief form (rev. What should i know before i file irs form 8857? Video walkthrough frequently asked questions where can i find irs form 8857? • while your request is being considered, the irs generally cannot collect any tax from you for the year(s).

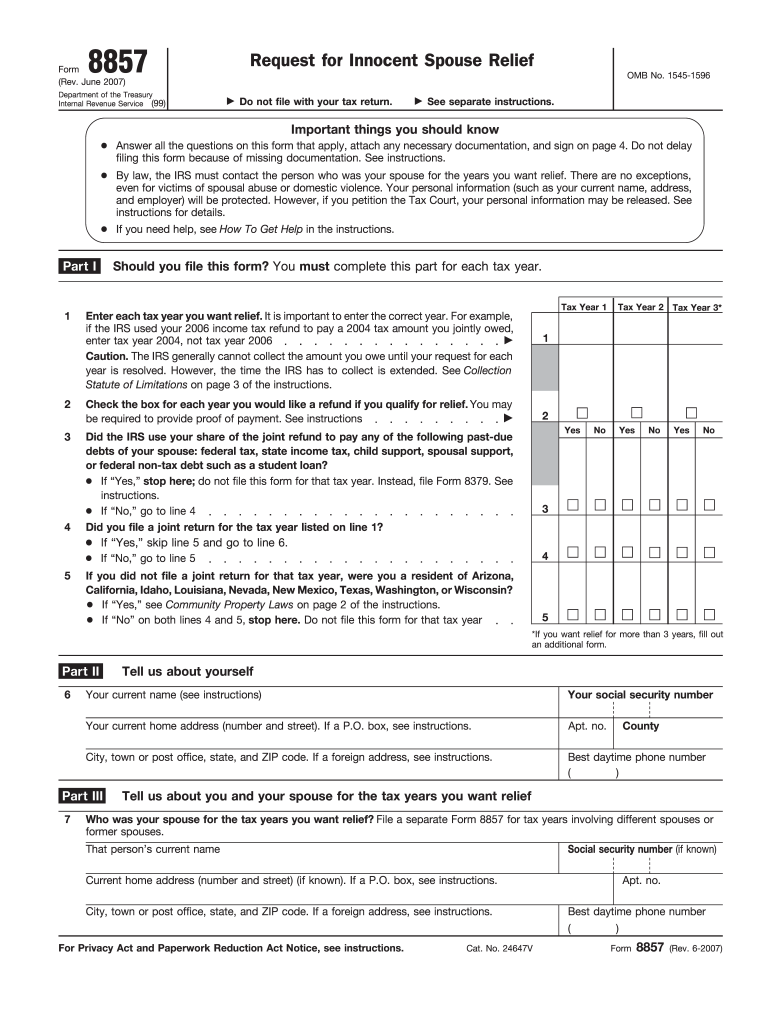

2007 Form IRS 8857 Fill Online, Printable, Fillable, Blank pdfFiller

Web use form 8857 to request relief from liability for tax, plus related penalties and interest, that you believe should be paid only by your spouse (or former spouse). • while your request is being considered, the irs generally cannot collect any tax from you for the year(s) you request relief. Video walkthrough frequently asked questions where can i find.

Form 8857 Request for Innocent Spouse Relief (2014) Free Download

Internal revenue service (99) important things you should know • do not file this form with your tax return. Related tax forms what do you think? Web 8857 request for innocent spouse relief form (rev. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a.

Form 8857 Request For Innocent Spouse Relief, Separation Of Liability

Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. June 2021) request for innocent spouse relief section references are to the internal revenue code unless otherwise noted. What should i know before i file irs form 8857? Web employer's quarterly.

The Fastest Way To Convert PDF To Fillable IRS Form 8857

Web the irs is examining your tax return and proposing to increase your tax liability. Instructions for form 941 pdf However, you must generally file form 8857 no later than 2 years after the first irs attempt to collect the tax from you. How do i fill out irs form 8857? You generally must have filed a joint return for.

Form 8857 Request for Innocent Spouse Relief (2014) Free Download

Web instructions for form 8857 (rev. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. Web employer's quarterly federal tax return. Video walkthrough frequently asked questions where can i find irs form 8857? Web what is irs form 8857?

Instructions For Form 8857 Request For Innocent Spouse Relief

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. The irs sends you a notice. June 2021) request for innocent spouse relief section references are to the internal revenue code unless otherwise noted. However, you must generally file form 8857 no later.

Printable Tax Form 8857 Master of Documents

You generally must have filed a joint return for the year(s) for which you are requesting relief (but see community property laws on page 3). Web 8857 request for innocent spouse relief form (rev. Web the irs is examining your tax return and proposing to increase your tax liability. Web information about form 8857, request for innocent spouse relief, including.

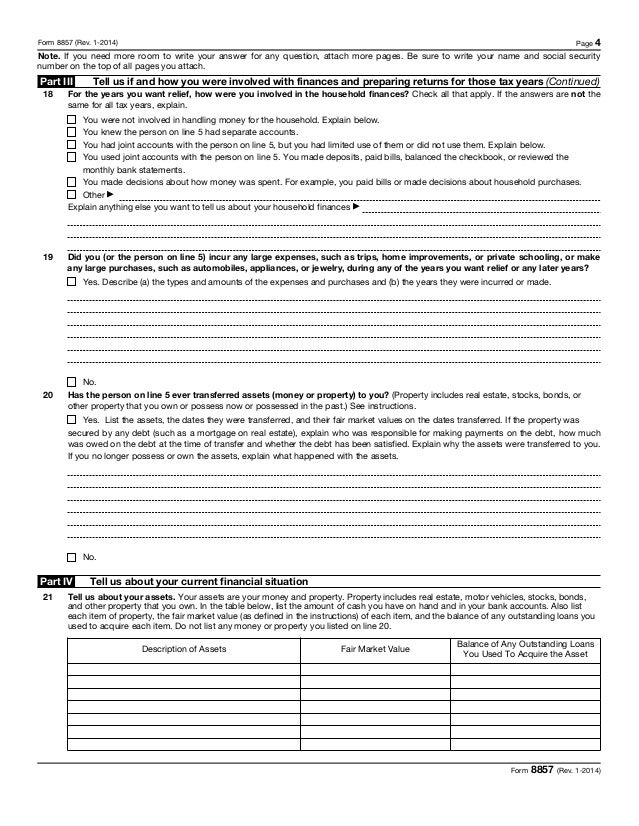

Internal revenue service (99) important things you should know • do not file this form with your tax return. Video walkthrough frequently asked questions where can i find irs form 8857? Instructions for form 941 pdf Related tax forms what do you think? Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. Web 8857 request for innocent spouse relief form (rev. Innocent spouse relief separation of liability relief equitable relief when should i file irs form 8857? How do i fill out irs form 8857? See where to file in the instructions. • while your request is being considered, the irs generally cannot collect any tax from you for the year(s) you request relief. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. • review and follow the instructions to complete this form. Web what is irs form 8857? June 2021) request for innocent spouse relief section references are to the internal revenue code unless otherwise noted. Web the irs is examining your tax return and proposing to increase your tax liability. What should i know before i file irs form 8857? Web use form 8857 to request relief from liability for tax, plus related penalties and interest, that you believe should be paid only by your spouse (or former spouse). Web instructions for form 8857 (rev. (but see the exceptions below for different filing deadlines that apply.)

Web Use Form 8857 To Request Relief From Liability For Tax, Plus Related Penalties And Interest, That You Believe Should Be Paid Only By Your Spouse (Or Former Spouse).

Innocent spouse relief separation of liability relief equitable relief when should i file irs form 8857? How do i fill out irs form 8857? See where to file in the instructions. You generally must have filed a joint return for the year(s) for which you are requesting relief (but see community property laws on page 3).

June 2021) Request For Innocent Spouse Relief Section References Are To The Internal Revenue Code Unless Otherwise Noted.

• while your request is being considered, the irs generally cannot collect any tax from you for the year(s) you request relief. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. (but see the exceptions below for different filing deadlines that apply.) Video walkthrough frequently asked questions where can i find irs form 8857?

Web The Irs Is Examining Your Tax Return And Proposing To Increase Your Tax Liability.

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web employer's quarterly federal tax return. Web what is irs form 8857? Related tax forms what do you think?

Instructions For Form 941 Pdf

However, you must generally file form 8857 no later than 2 years after the first irs attempt to collect the tax from you. Web 8857 request for innocent spouse relief form (rev. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. Web instructions for form 8857 (rev.