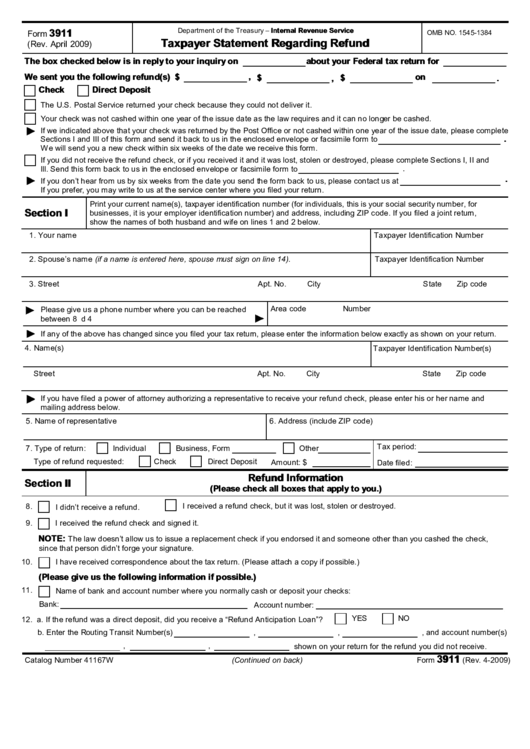

Irs Form 3911 Printable - Web irs form 3911, taxpayer statement regarding refund, is the tax form that a taxpayer may use to inform the irs of a missing tax refund. Web go to “where’s my refund?” at irs.gov or use the irs2go mobile app and follow the prompts to begin a refund trace. The form must be completed and mailed or faxed to the specified irs office. By filing this form, the taxpayer initiates a refund trace. Form 3911 is used by a taxpayer who was issued a refund either by direct deposit or. Web regardless of the reason for never receiving your tax refund, filing form 3911 with the irs helps trace your refund to determine its whereabouts. Form 3911 is also known as a taxpayer statement regarding refund. The information below is in reply to your inquiry on. Web print your current name(s), taxpayer identification number (for individuals, this is your social security number, for businesses, it is your employer identification number) and address, including zip code. Web what is a form 3911, taxpayer statement regarding refund?

Irs Form 1310 Printable Master of Documents

Web what is a form 3911, taxpayer statement regarding refund? Web go to “where’s my refund?” at irs.gov or use the irs2go mobile app and follow the prompts to begin a refund trace. Form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service.

20182022 Form IRS 3911 Fill Online, Printable, Fillable, Blank pdfFiller

Form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service representative. A taxpayer completes this form to inquire about the status of an expected refund. More about the federal form 3911 we last updated federal form 3911 in december 2022 from the federal.

941 Worksheet 1 2020 Fillable Pdf

Irfof provides the mailing address and fax number of the predetermined accounts management campus to mail the form 3911. By filing this form, the taxpayer initiates a refund trace. Web information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on how to file. While predominantly used for tax refunds, form 3911 has also been.

Form 3911 Printable

Married filing joint taxpayers must complete and jointly sign the form 3911 and return it to the irs before a refund trace can be initiated by the refund inquiry examiner. About your federal tax refund forif you did not receive your refund or if the refund check you received was lost, stolen or destroyed, complete the. Form 3911 is used.

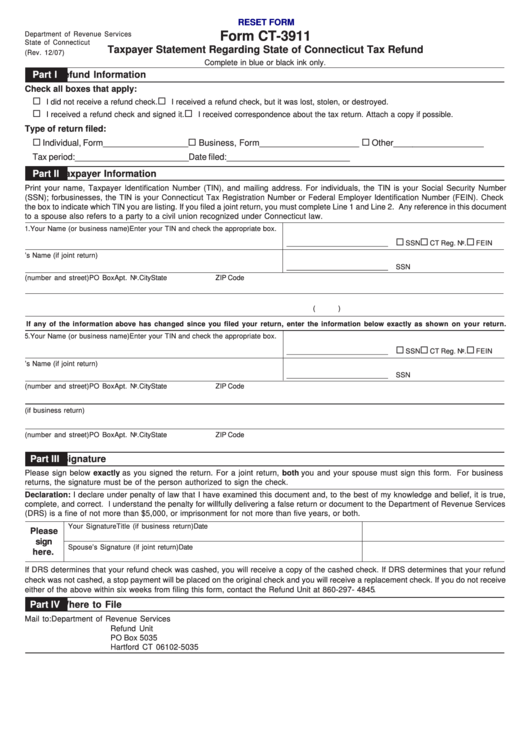

Fillable Form Ct3911 Taxpayer Statement Regarding State Of

Married filing joint taxpayers must complete and jointly sign the form 3911 and return it to the irs before a refund trace can be initiated by the refund inquiry examiner. To complete this document, you'll need certain information about the. What is the irs refund trace process like? Web go to “where’s my refund?” at irs.gov or use the irs2go.

Form 3911 Taxpayer Statement Regarding Refund (Fillible) printable

What is the irs refund trace process like? Web regardless of the reason for never receiving your tax refund, filing form 3911 with the irs helps trace your refund to determine its whereabouts. To complete this document, you'll need certain information about the. More about the federal form 3911 we last updated federal form 3911 in december 2022 from the.

2006 Form CT CT3911 Fill Online, Printable, Fillable, Blank pdfFiller

Web print your current name(s), taxpayer identification number (for individuals, this is your social security number, for businesses, it is your employer identification number) and address, including zip code. Married filing joint taxpayers must complete and jointly sign the form 3911 and return it to the irs before a refund trace can be initiated by the refund inquiry examiner. Web.

Form 3911 Taxpayer Statement Regarding Refund (2012) Free Download

Form 3911 is also known as a taxpayer statement regarding refund. What is the irs refund trace process like? The form must be completed and mailed or faxed to the specified irs office. More about the federal form 3911 we last updated federal form 3911 in december 2022 from the federal internal revenue service. Web irs form 3911, taxpayer statement.

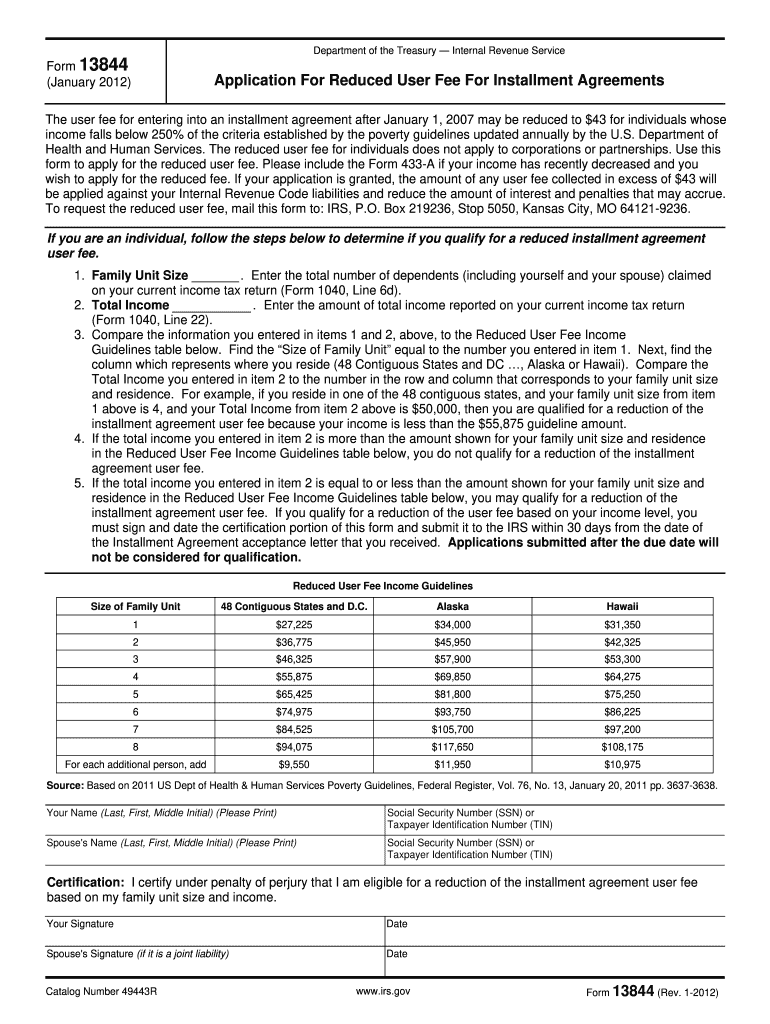

Irs form 13844 2012 Fill out & sign online DocHub

Web regardless of the reason for never receiving your tax refund, filing form 3911 with the irs helps trace your refund to determine its whereabouts. What is the irs refund trace process like? If successful, the irs will issue a replacement check to the taxpayer. You need to complete form 3911, taxpayer statement regarding refund, and mail it to the.

How To Sign 1040 With Power Of Attorney

To complete this document, you'll need certain information about the. Web what is a form 3911, taxpayer statement regarding refund? While predominantly used for tax refunds, form 3911 has also been utilized for missing economic impact payments that were issued pursuant to the cares act. What is the irs refund trace process like? Irfof provides the mailing address and fax.

If successful, the irs will issue a replacement check to the taxpayer. Web regardless of the reason for never receiving your tax refund, filing form 3911 with the irs helps trace your refund to determine its whereabouts. Form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service representative. Form 3911 is also known as a taxpayer statement regarding refund. A taxpayer completes this form to inquire about the status of an expected refund. Web go to “where’s my refund?” at irs.gov or use the irs2go mobile app and follow the prompts to begin a refund trace. Web information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on how to file. This form is for income earned in tax year 2022, with tax returns due in april 2023. You need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs address where you would normally file a paper tax return. To complete this document, you'll need certain information about the. About your federal tax refund forif you did not receive your refund or if the refund check you received was lost, stolen or destroyed, complete the. By filing this form, the taxpayer initiates a refund trace. More about the federal form 3911 we last updated federal form 3911 in december 2022 from the federal internal revenue service. The information below is in reply to your inquiry on. What is the irs refund trace process like? Web what is a form 3911, taxpayer statement regarding refund? If your filing status is married filing jointly. The form must be completed and mailed or faxed to the specified irs office. Web irs form 3911, taxpayer statement regarding refund, is the tax form that a taxpayer may use to inform the irs of a missing tax refund. While predominantly used for tax refunds, form 3911 has also been utilized for missing economic impact payments that were issued pursuant to the cares act.

Form 3911 Is Used By A Taxpayer Who Was Issued A Refund Either By Direct Deposit Or.

More about the federal form 3911 we last updated federal form 3911 in december 2022 from the federal internal revenue service. The form must be completed and mailed or faxed to the specified irs office. What is the irs refund trace process like? Married filing joint taxpayers must complete and jointly sign the form 3911 and return it to the irs before a refund trace can be initiated by the refund inquiry examiner.

Form 3911 Is Provided To Individuals Who Do Not Qualify To Request A Replacement Check Through The Internet, Automated Phone System Or By Contacting A Customer Service Representative.

Web irs form 3911, taxpayer statement regarding refund, is the tax form that a taxpayer may use to inform the irs of a missing tax refund. This form is for income earned in tax year 2022, with tax returns due in april 2023. By filing this form, the taxpayer initiates a refund trace. A taxpayer completes this form to inquire about the status of an expected refund.

While Predominantly Used For Tax Refunds, Form 3911 Has Also Been Utilized For Missing Economic Impact Payments That Were Issued Pursuant To The Cares Act.

Web regardless of the reason for never receiving your tax refund, filing form 3911 with the irs helps trace your refund to determine its whereabouts. About your federal tax refund forif you did not receive your refund or if the refund check you received was lost, stolen or destroyed, complete the. If successful, the irs will issue a replacement check to the taxpayer. Web print your current name(s), taxpayer identification number (for individuals, this is your social security number, for businesses, it is your employer identification number) and address, including zip code.

Web Information About Form 3911, Taxpayer Statement Regarding Refund, Including Recent Updates, Related Forms, And Instructions On How To File.

You need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs address where you would normally file a paper tax return. To complete this document, you'll need certain information about the. Irfof provides the mailing address and fax number of the predetermined accounts management campus to mail the form 3911. Web go to “where’s my refund?” at irs.gov or use the irs2go mobile app and follow the prompts to begin a refund trace.