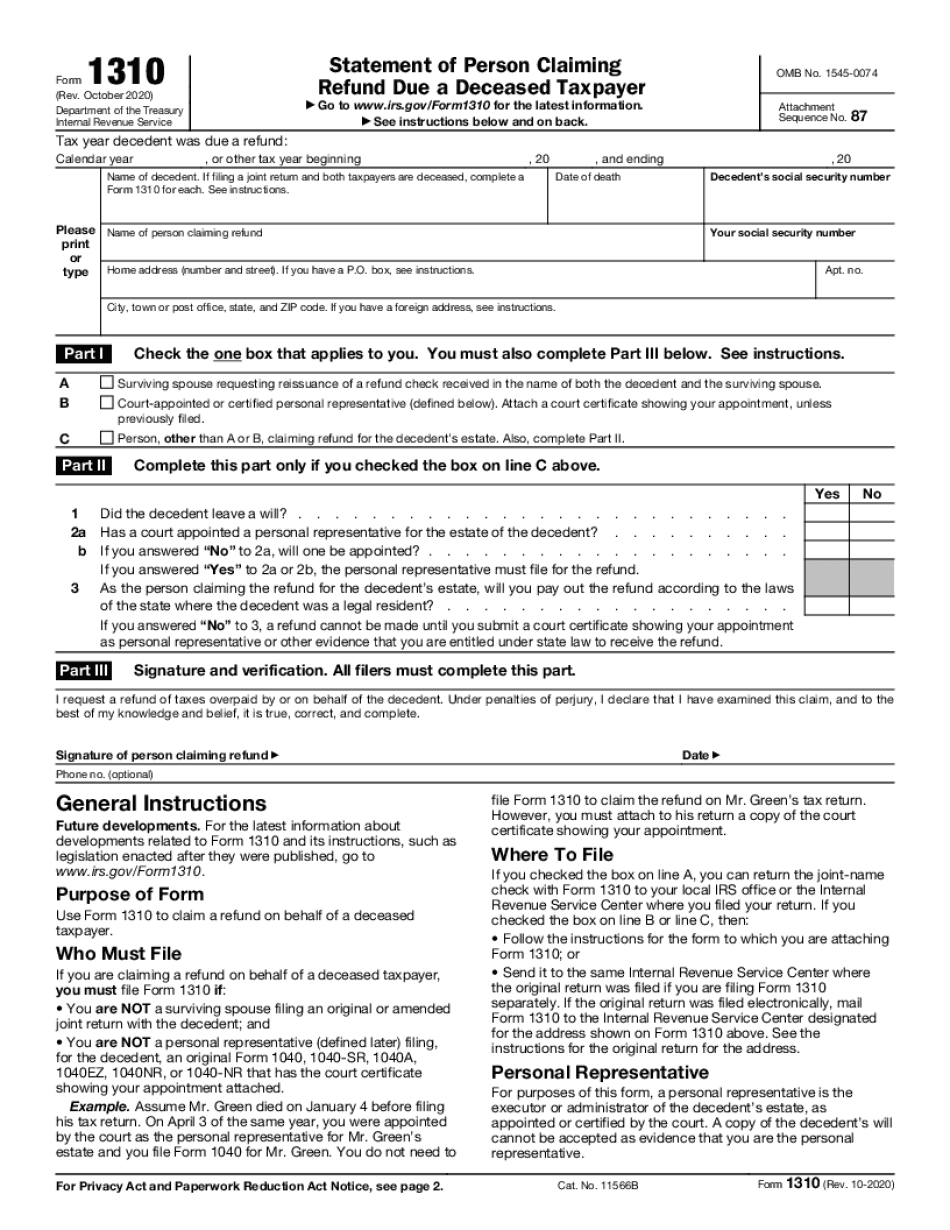

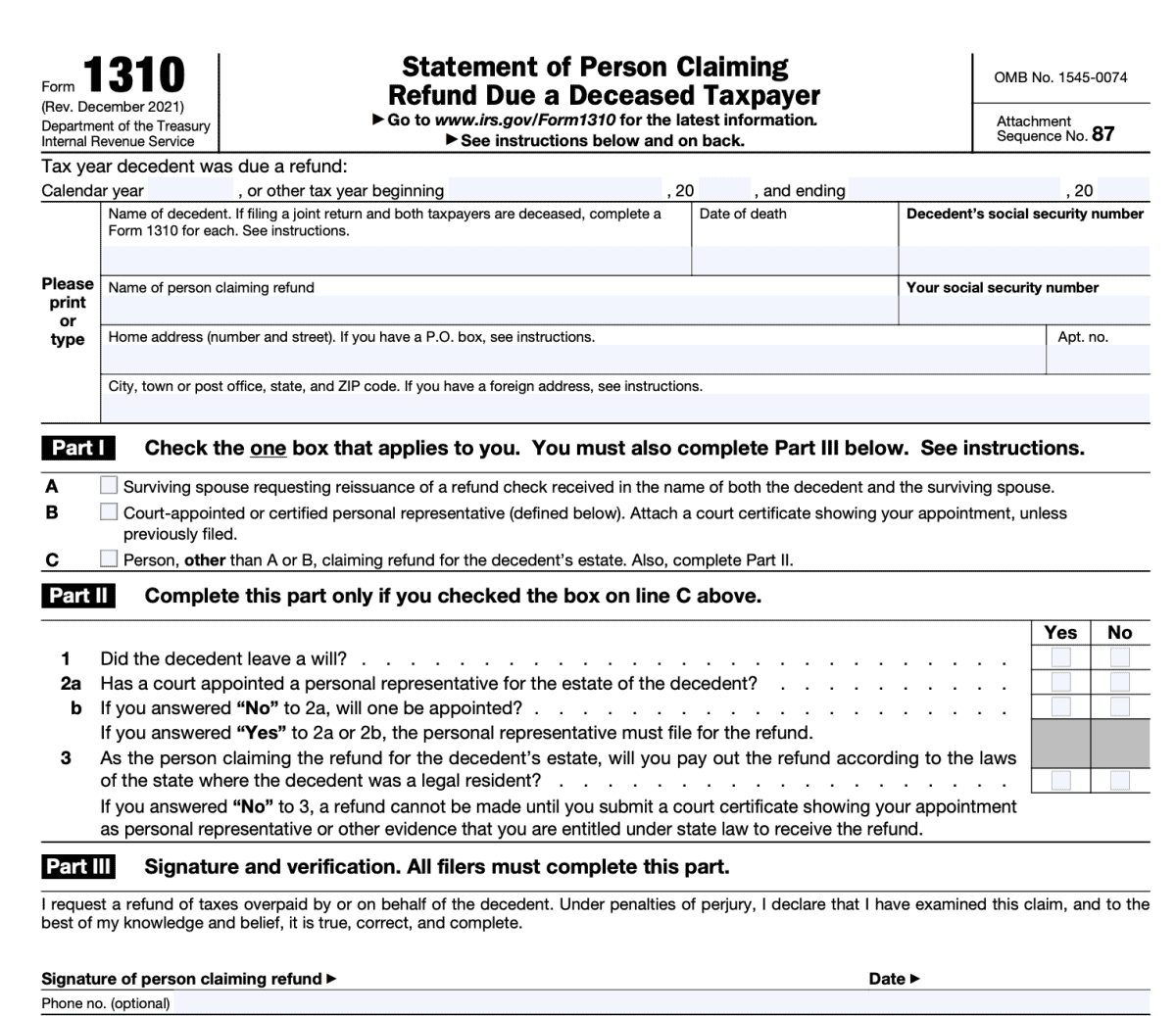

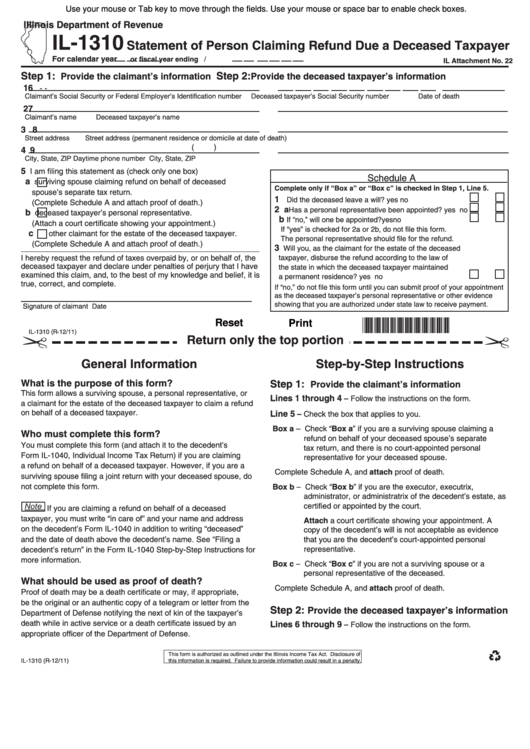

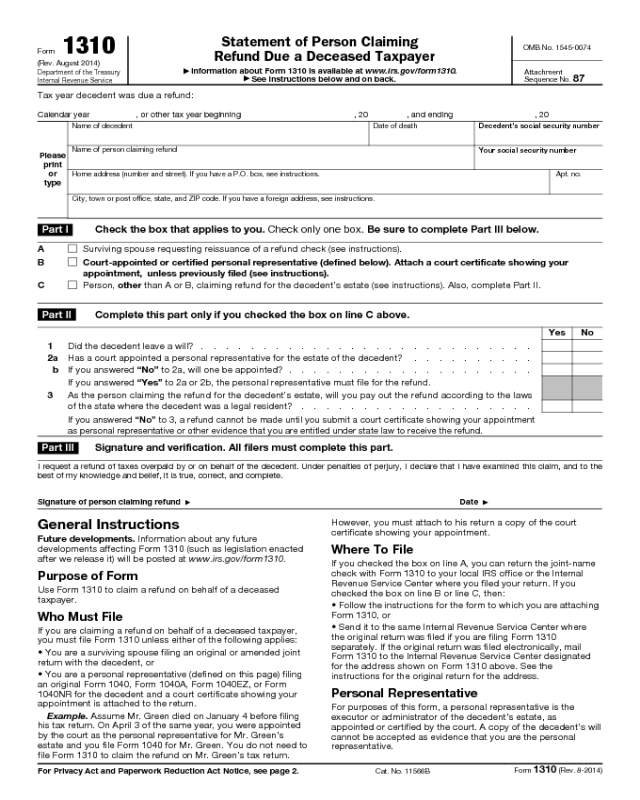

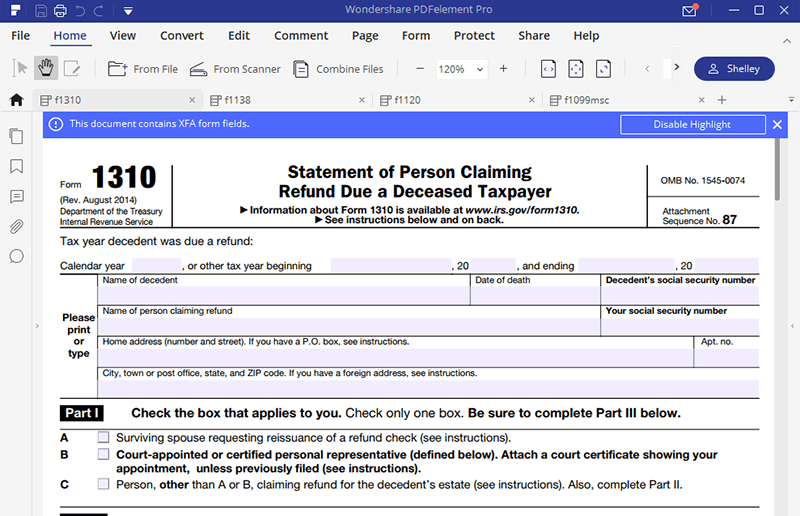

Irs Form 1310 Printable - Let’s begin by walking through form 1310, step by step. Green died on january 4 before filing his tax return. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: You are not a surviving spouse filing an original or amended joint return with the decedent; Web tax year decedent was due a refund: Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Date of death decedent’s social security number Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their beneficiaries and/or estate. The statement is prepared and served as an attachment to the original tax report and filed with the irs, following the basic tax report recommendations. Download your fillable irs form 1310 in pdf.

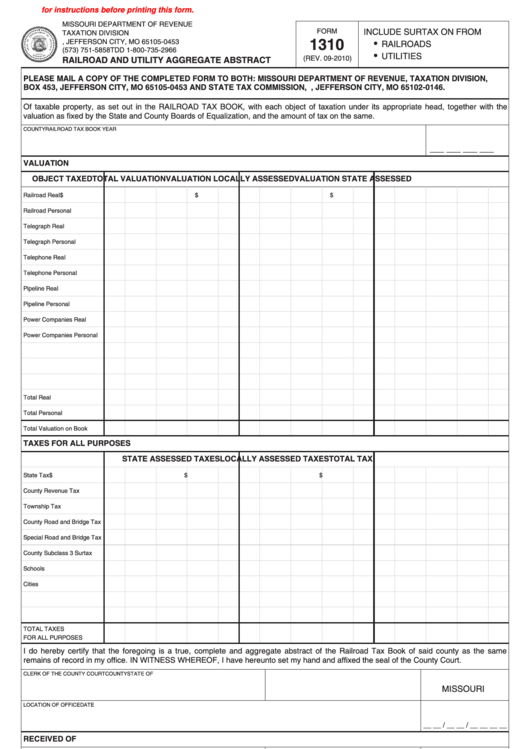

Fillable Form 1310 Railroad And Utility Aggregate Abstract 2010

Web collect the right amount of tax. Let’s begin by walking through form 1310, step by step. Date of death decedent’s social security number You are not a surviving spouse filing an original or amended joint return with the decedent; Web get federal tax return forms and file by mail.

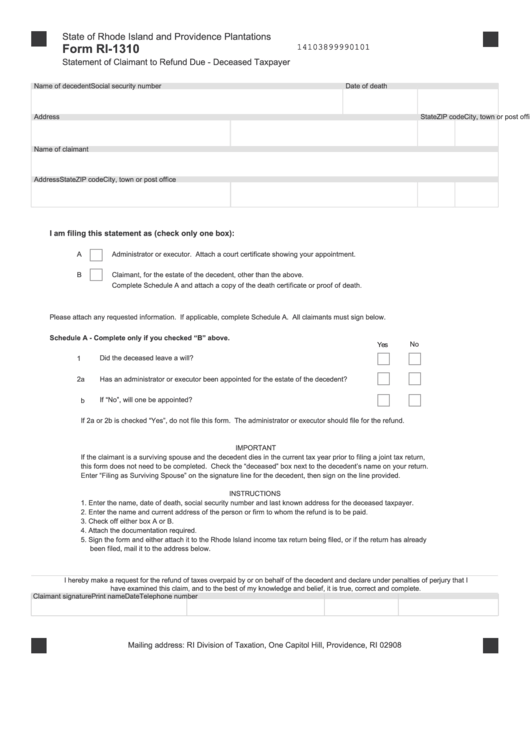

Fillable Form Ri1310 Statement Of Claimant To Refund Due Deceased

Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their beneficiaries and/or estate. Green died on january 4 before filing his tax return. Web collect the right amount of tax. Web part i part ii part iii what is irs form 1310? If filing a joint return.

Irs Form 1310 Printable 2020 2021 Blank Sample to Fill out Online

Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 if: If filing a joint return and both taxpayers are deceased, complete a form 1310 for each. More about the federal form 1310 we last updated federal form 1310 in january 2023 from the federal internal revenue service. Green died.

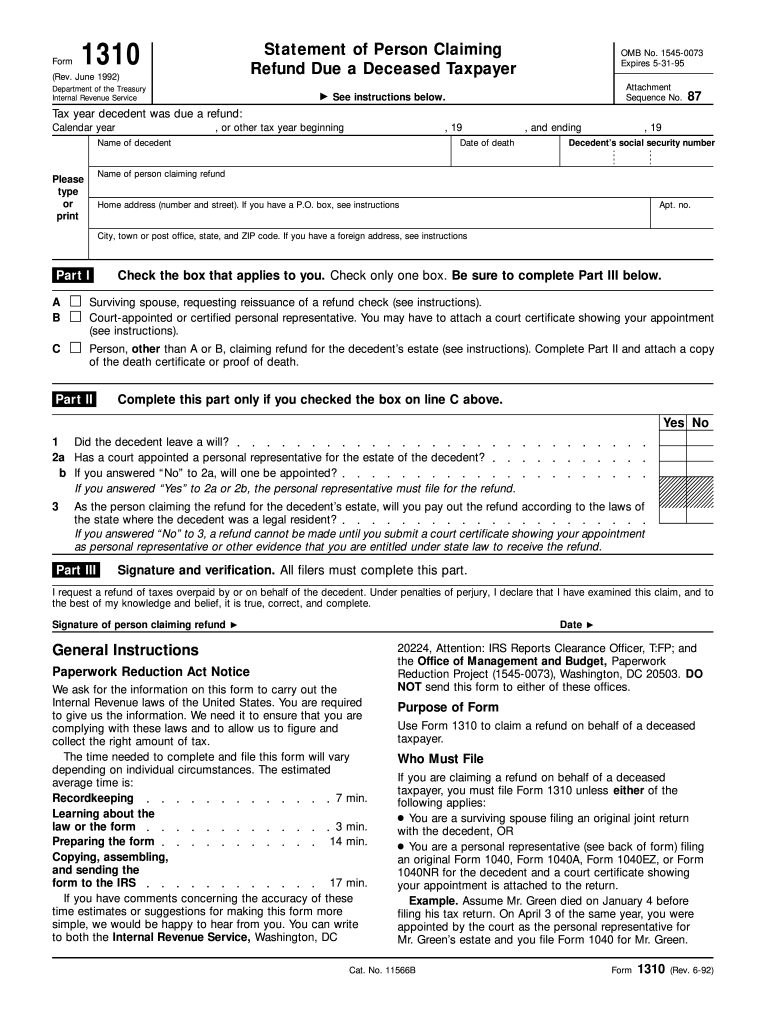

1992 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. On april 3 of the same year, you were appointed This form is for income earned in tax year 2022, with tax returns due in april 2023. The statement is prepared and served as an attachment to the original tax report and filed.

What is IRS Form 1310? Claiming Refund Due a Deceased Taxpayer

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Download your fillable irs form 1310 in pdf. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: This form is for income earned in tax year 2022, with tax returns due in april.

Fillable Form Il1310 Statement Of Person Claiming Refund Due A

Irs form 1310 is executed to support the application for the deceased’s refund for the tax year at issue. Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 if: This form is for income earned in tax year 2022, with tax returns due in april 2023. Web form 1310.

Irs Form 1310 Printable Master of Documents

Calendar year , or other tax year beginning , 20 , and ending , 20 please print or type name of decedent. Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their beneficiaries and/or estate. Irs form 1310 is executed to support the application for the deceased’s.

2022 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

On april 3 of the same year, you were appointed More about the federal form 1310 we last updated federal form 1310 in january 2023 from the federal internal revenue service. Web collect the right amount of tax. Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by.

1310 Affidavit New York Fill Online, Printable, Fillable, Blank

The statement is prepared and served as an attachment to the original tax report and filed with the irs, following the basic tax report recommendations. Who must file irs form 1310? You are not a surviving spouse filing an original or amended joint return with the decedent; If you are claiming a refund on behalf of a deceased taxpayer, you.

IRS Form 1310 How to Fill it Right

Download your fillable irs form 1310 in pdf. More about the federal form 1310 we last updated federal form 1310 in january 2023 from the federal internal revenue service. The statement is prepared and served as an attachment to the original tax report and filed with the irs, following the basic tax report recommendations. Who must file if you are.

Let’s begin by walking through form 1310, step by step. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: The form is filed as part of a. On april 3 of the same year, you were appointed The statement is prepared and served as an attachment to the original tax report and filed with the irs, following the basic tax report recommendations. Download your fillable irs form 1310 in pdf. Use form 1310 to claim a refund on behalf of a deceased taxpayer. If filing a joint return and both taxpayers are deceased, complete a form 1310 for each. Who must file irs form 1310? Web part i part ii part iii what is irs form 1310? Case study examples taxpayer filing irs form 1310 taxpayer doesn’t have to file irs form 1310 video walkthrough frequently asked questions where can i get a copy of irs form 1310? Date of death decedent’s social security number Calendar year , or other tax year beginning , 20 , and ending , 20 please print or type name of decedent. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Web tax year decedent was due a refund: You are not a surviving spouse filing an original or amended joint return with the decedent; Web get federal tax return forms and file by mail. This form is for income earned in tax year 2022, with tax returns due in april 2023. More about the federal form 1310 we last updated federal form 1310 in january 2023 from the federal internal revenue service. Web collect the right amount of tax.

The Statement Is Prepared And Served As An Attachment To The Original Tax Report And Filed With The Irs, Following The Basic Tax Report Recommendations.

Web get federal tax return forms and file by mail. Who must file irs form 1310? Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. The form is filed as part of a.

Get Paper Copies Of Federal And State Tax Forms, Their Instructions, And The Address For Mailing Them.

If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web collect the right amount of tax. Web tax year decedent was due a refund: Download your fillable irs form 1310 in pdf.

More About The Federal Form 1310 We Last Updated Federal Form 1310 In January 2023 From The Federal Internal Revenue Service.

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Green died on january 4 before filing his tax return. You are not a surviving spouse filing an original or amended joint return with the decedent; Statement of person claiming refund due a deceased taxpayer created date:

If Filing A Joint Return And Both Taxpayers Are Deceased, Complete A Form 1310 For Each.

Web part i part ii part iii what is irs form 1310? Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 if: Let’s begin by walking through form 1310, step by step. Web use form 1310 to claim a refund on behalf of a deceased taxpayer.