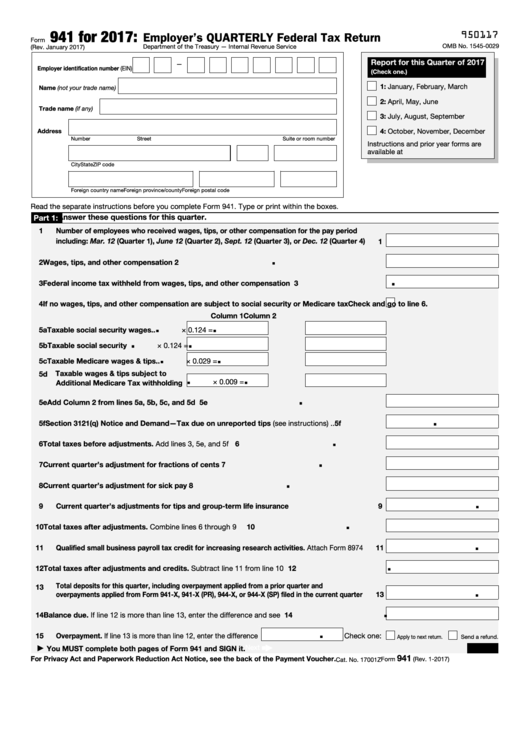

941 Reconciliation Template Excel - Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. The goal is to confirm that the numbers. Don't use an earlier revision to report taxes for 2023. Document the following items on the reconciliation spreadsheet: Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Make sure you retain your reconciliation information. Web form 941 worksheet for 2022. Proceed until the excel template appears a. You must complete all three.

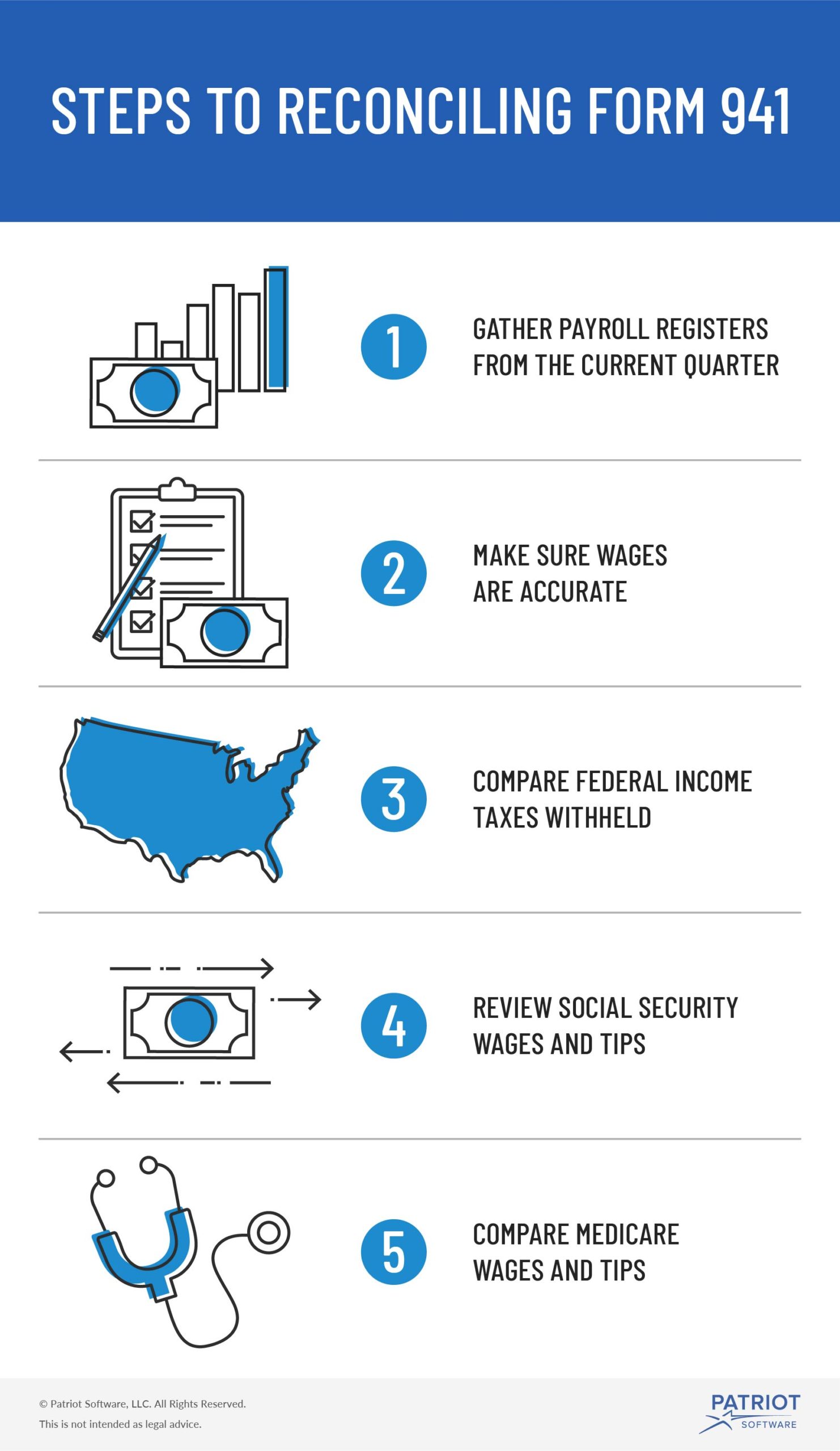

What to Know About Form 941 Reconciliation Steps, Due Dates, & More

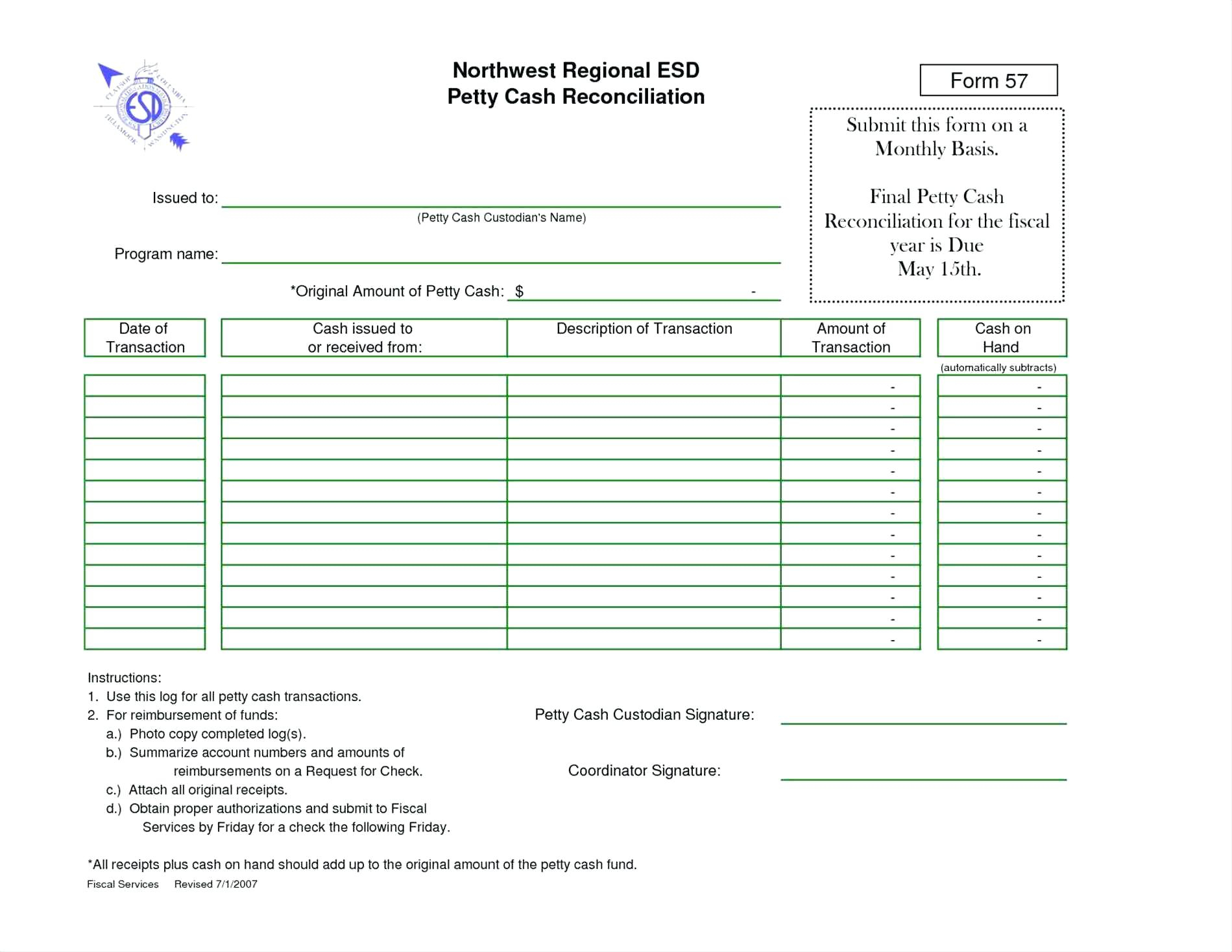

Make sure you retain your reconciliation information. Use on any account, petty cash, ledger, or. Your total payroll expenses must match what you’ve posted in your general ledger. The goal is to confirm that the numbers. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check.

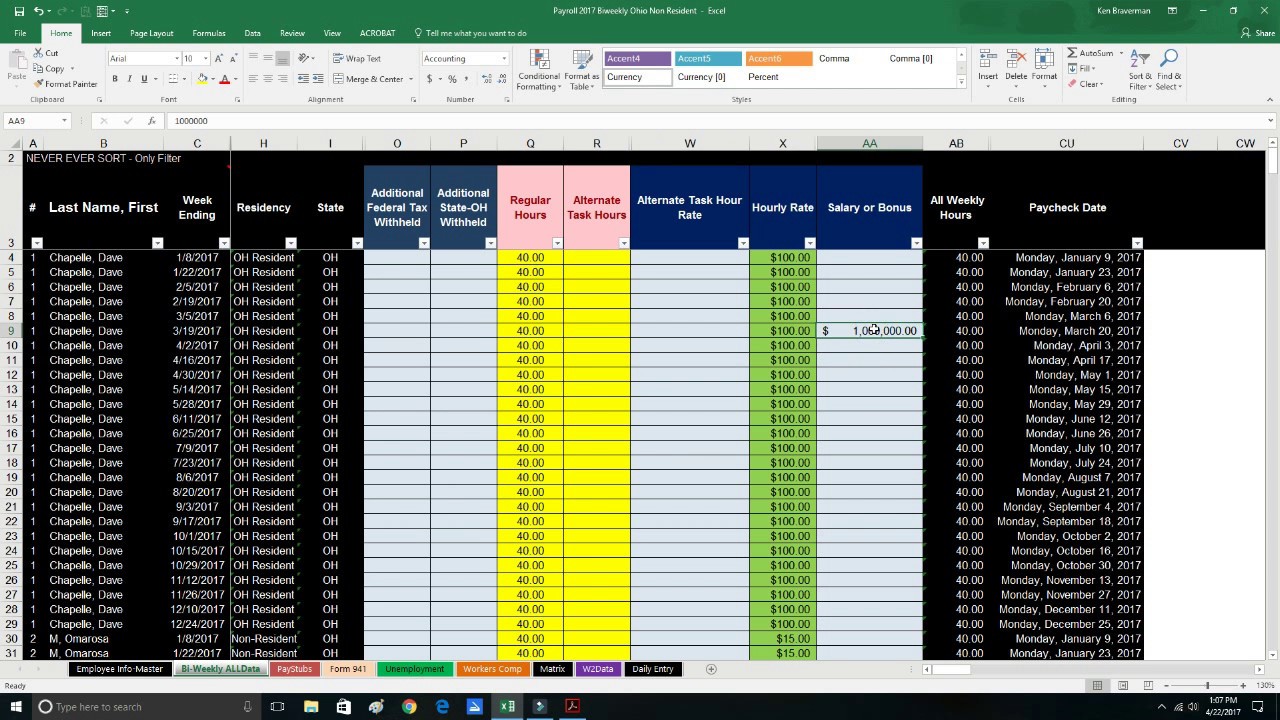

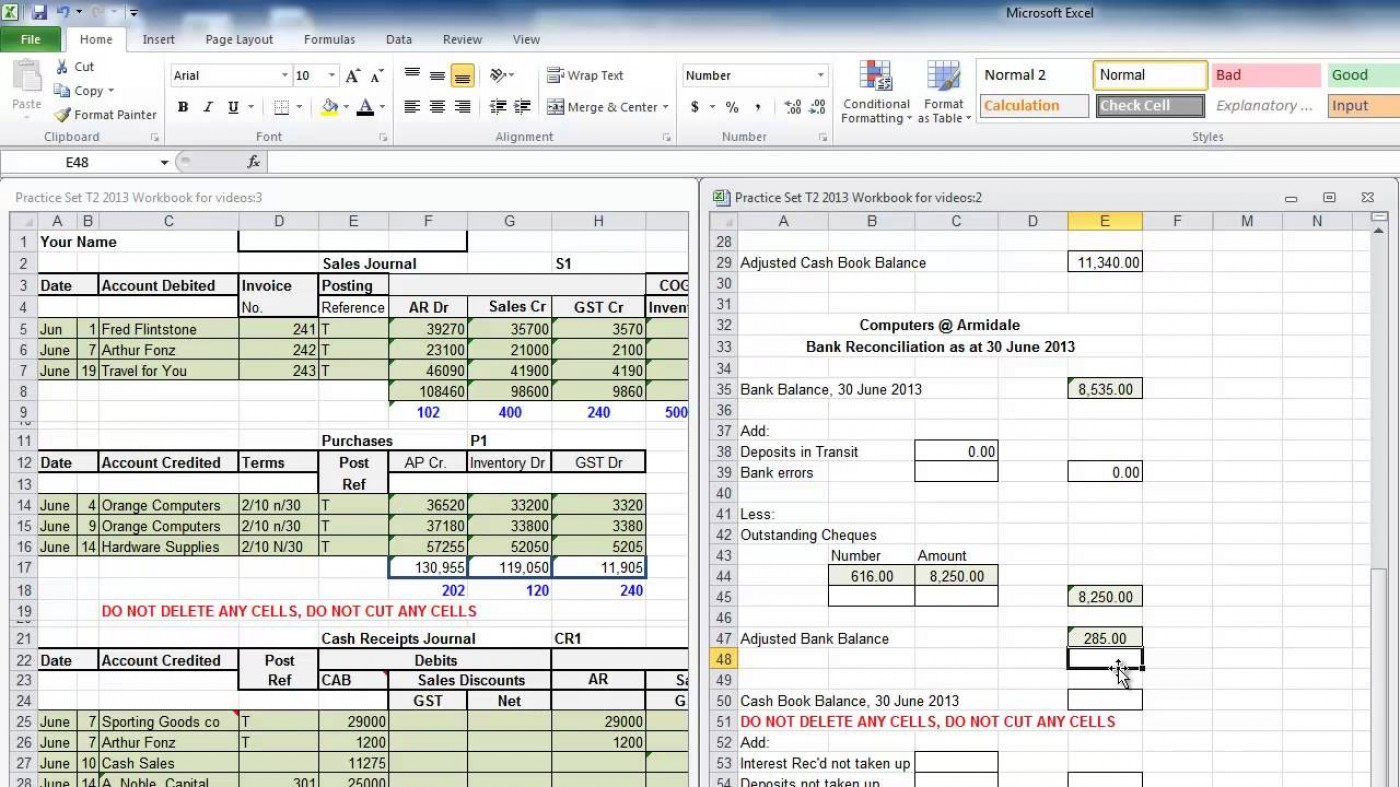

How to File Quarterly Form 941 Payroll in Excel 2017 YouTube

Run a report that shows annual payroll amounts. Proceed until the excel template appears a. Does my general ledger match my payroll expenses? You must complete all five pages. If these forms are not in balance, penalties from the irs and/or ssa could result.

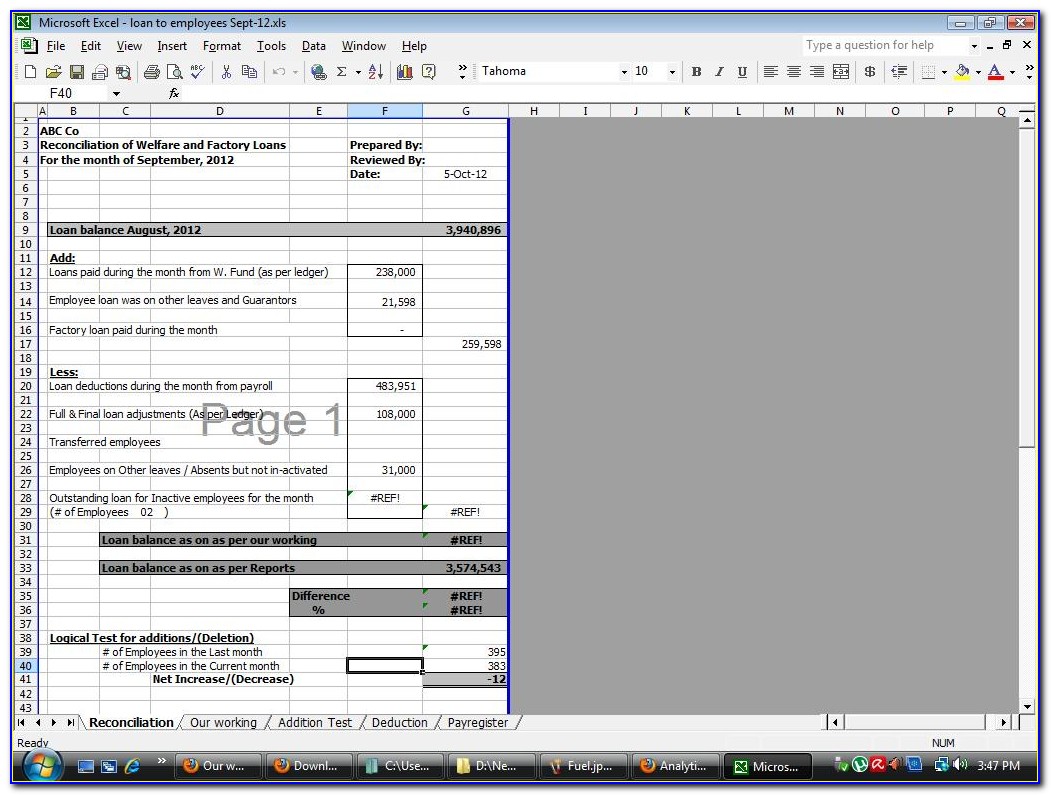

Payroll Reconciliation Excel Template Uk

To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. You must complete all five pages. Web form 941 worksheet for 2022. At this time, the irs. Does my general ledger match my payroll expenses?

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

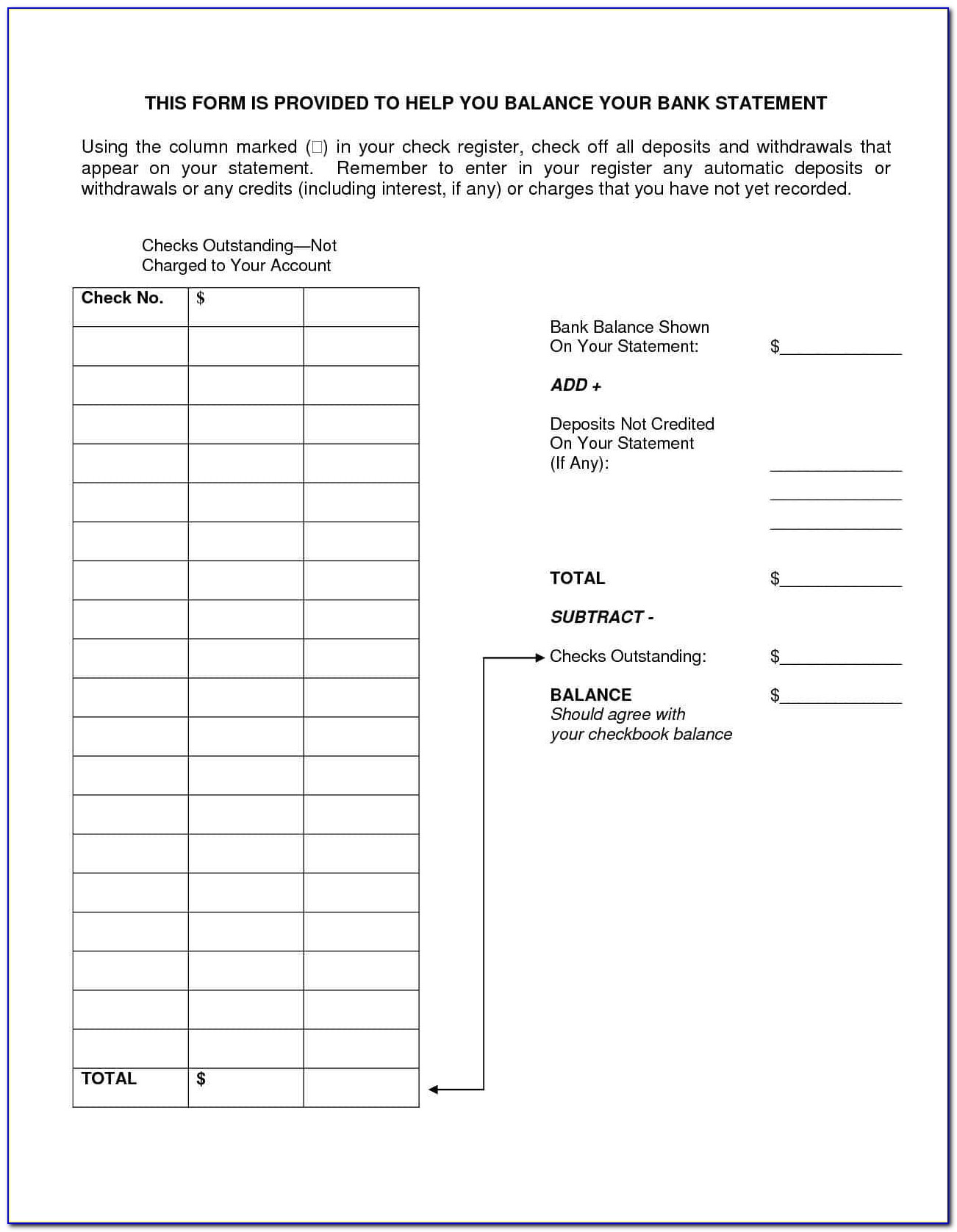

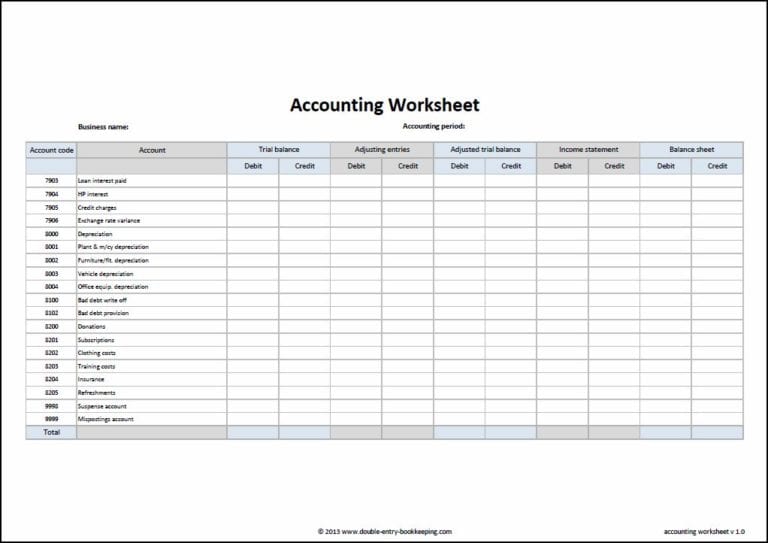

Does my general ledger match my payroll expenses? Run a report that shows annual payroll amounts. Web ðï ࡱ á> þÿ 1. Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation templates excel. Your total payroll expenses must match what you’ve posted in your general ledger.

Daily Cash Reconciliation Excel Template

You must complete all five pages. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. You must complete all three. Make sure you retain your reconciliation information. Select the ‘open’ option 3.

Bank Reconciliation Excel Spreadsheet for Excel Spreadsheet For

Don't use an earlier revision to report taxes for 2023. At this time, the irs. Your total payroll expenses must match what you’ve posted in your general ledger. Web refer to sample excel reconciliation template. Type or print within the boxes.

General Ledger Account Reconciliation Template —

This worksheet does not have to be. Select the ‘open’ option 3. Type or print within the boxes. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet.

Inventory Reconciliation Format In Excel Excel Templates

Fill in the empty fields; Does my general ledger match my payroll expenses? Don't use an earlier revision to report taxes for 2023. Thus, any employer who files the quarterly. Web form 941 worksheet for 2022.

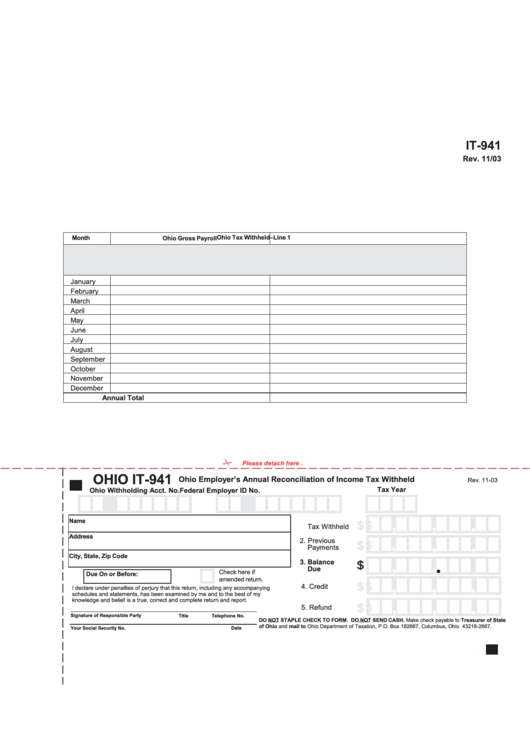

Form It941 Employer'S Annual Reconciliation Of Tax Withheld

Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation templates excel. If these forms are not in balance, penalties from the irs and/or ssa could result. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. Web form 941 worksheet for 2022. Web ðï ࡱ á> þÿ 1.

Bank Reconciliation Excel Spreadsheet —

Compare those figures with the totals reported on all four 941s for the year. Web ðï ࡱ á> þÿ 1. Make sure the amounts reported on. Web refer to sample excel reconciliation template. Document the following items on the reconciliation spreadsheet:

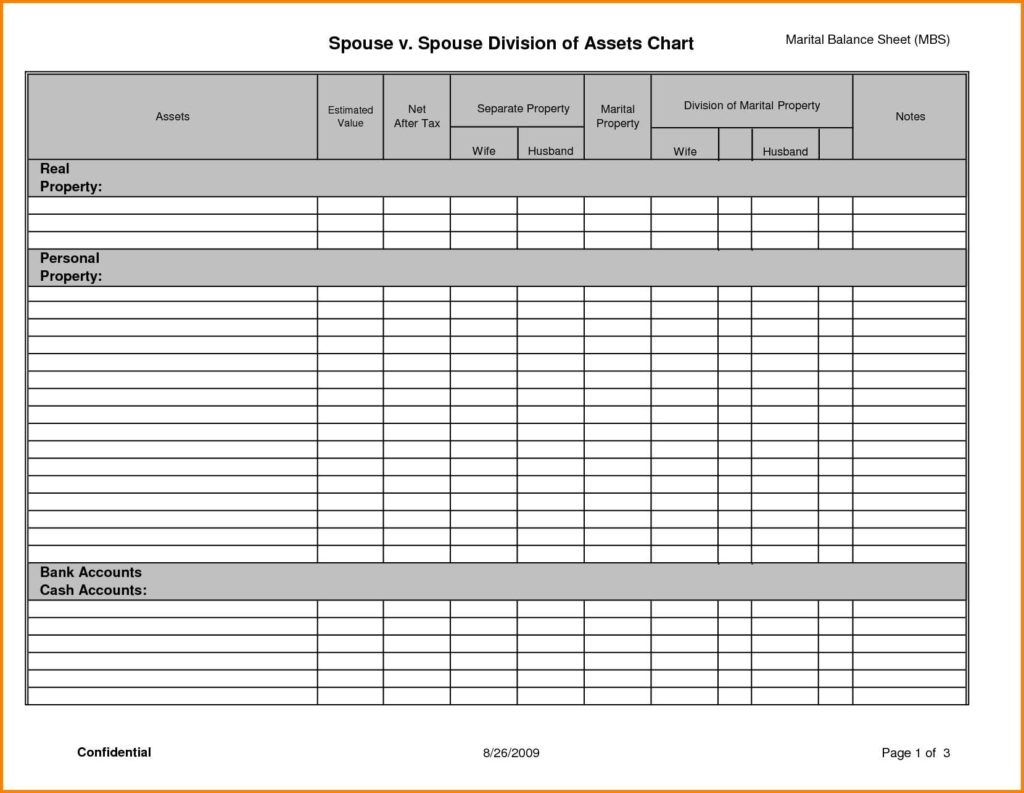

Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Select the ‘open’ option 3. Run a report that shows annual payroll amounts. Thus, any employer who files the quarterly. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. You must complete all five pages. Make sure the amounts reported on. Make sure you retain your reconciliation information. Use on any account, petty cash, ledger, or. Type or print within the boxes. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; At this time, the irs. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation templates excel. Fill in the empty fields; From the “enter tax return” portal page, click the ri bulk 941 upload template hyperlink 2. Web ðï ࡱ á> þÿ 1. Proceed until the excel template appears a. Engaged parties names, places of residence and phone. Document the following items on the reconciliation spreadsheet:

The Goal Is To Confirm That The Numbers.

If these forms are not in balance, penalties from the irs and/or ssa could result. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees. Engaged parties names, places of residence and phone. Web refer to sample excel reconciliation template.

Web Get The Form 941 Excel Template You Require.

Don't use an earlier revision to report taxes for 2023. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Does my general ledger match my payroll expenses? Web form 941 worksheet for 2022.

At This Time, The Irs.

Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Select the ‘open’ option 3. Your total payroll expenses must match what you’ve posted in your general ledger. Web ðï ࡱ á> þÿ 1.

Thus, Any Employer Who Files The Quarterly.

Fill in the empty fields; Document the following items on the reconciliation spreadsheet: Compare those figures with the totals reported on all four 941s for the year. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.